© 2026 Macro Global. All Rights Reserved.

Cross Border Payments

A Perfect Remittance Software That Any Cross-Border Remittance Business Truly Needs

NetRemit, an ISO Compliant White Label Remittance Platform built to deliver success by

Capitalising on Emerging Opportunities

NetRemit, a White-Labelled SaaS Remittance Platform to Empower International Money Transfer Business for

Banks, Neobanks

Forex, MTOs

Fintech

Retail Chains

Everything You Need for Your International Money Transfer Operations

Transform your cross-border payments business effortlessly with NetRemit, the best remittance software provider trusted for extensive industry expertise.

Remittance Software

Trusted globally, NetRemit guarantees efficient and future-proof money remittance operations, driven by innovation and a steadfast commitment to customer-centricity.

With robust technical capabilities, advanced security, strict compliance protocols, and a scalable architecture, it also ensures seamless transaction management.

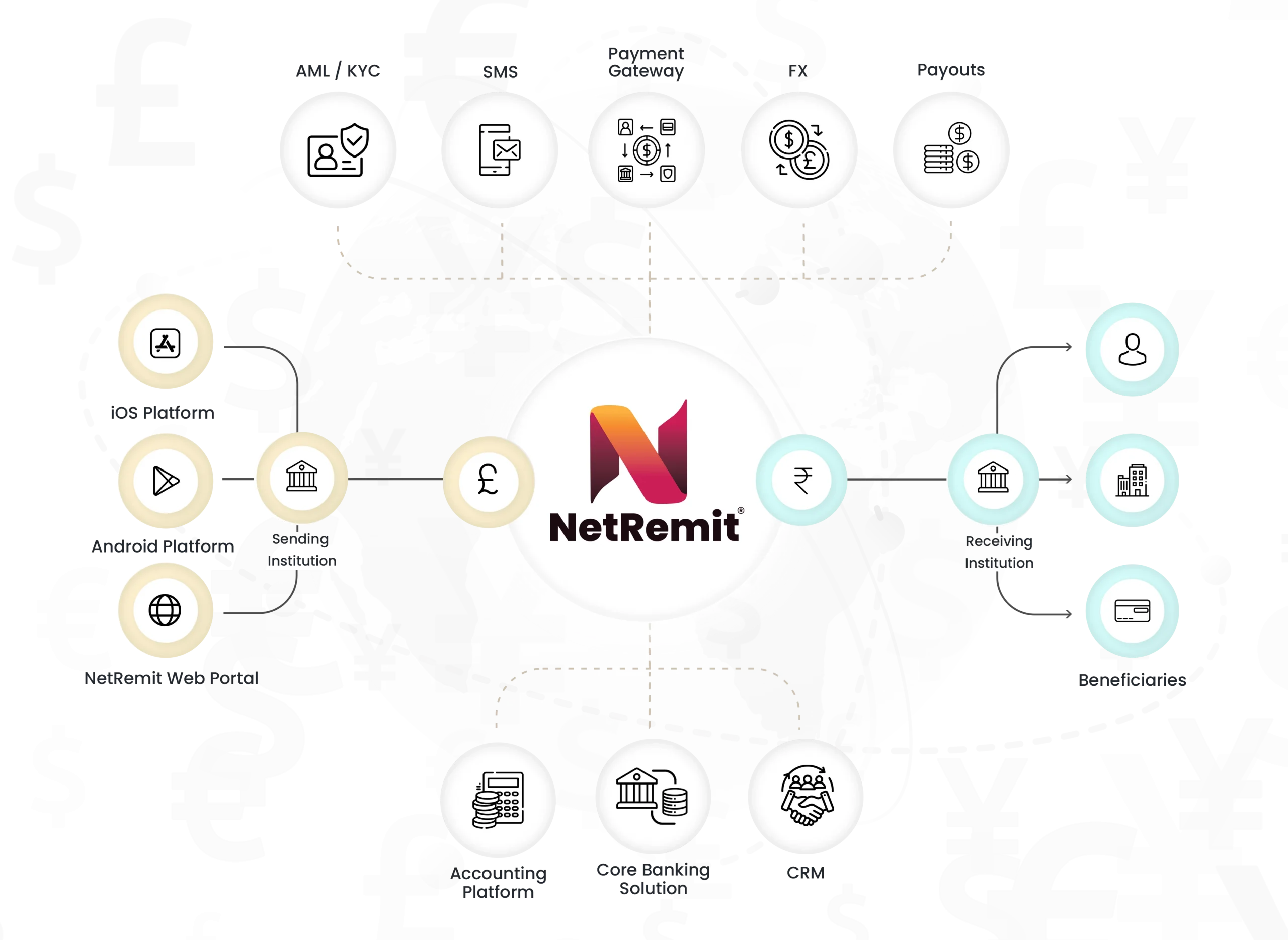

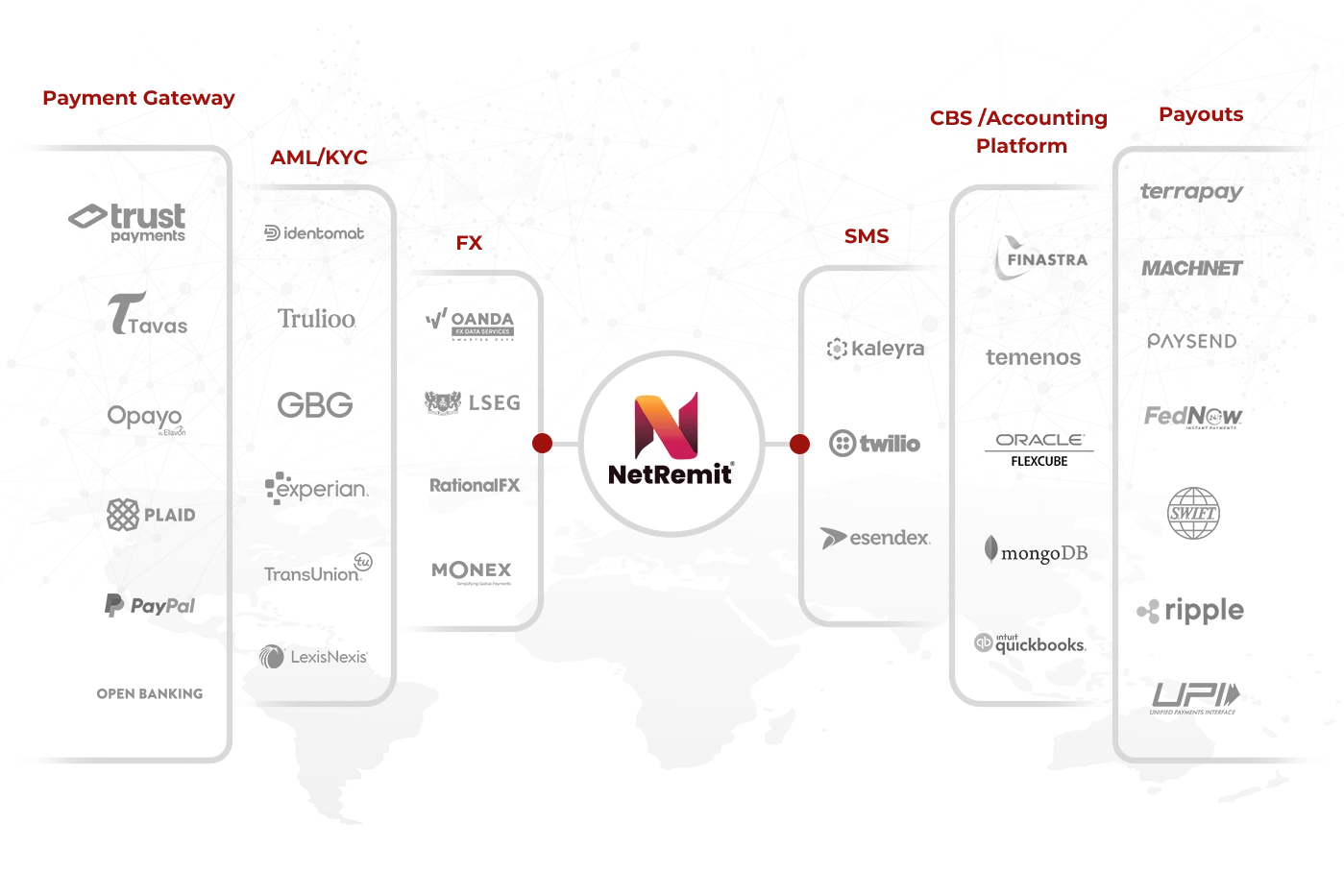

Integrations

Achieve quicker go-to-market with instant access to a pre-integrated network of leading partners ensuring a cost-effective, fast, secure, and frictionless remittance experience.

We do all the heavy lifting, delivering exceptional value by reducing costs and ensuring a rapid ROI.

Remittance Business Consulting

Whether you are a new entrant or an established business, we help you launch, grow, and streamline your online remittance business.

Our expert consulting services simplify the license-acquiring process, secure crucial partnerships, and craft a winning go-to-market strategy, ensuring compliance and operational readiness.

Discover the Power of an Immaculate Remittance Software Features to Revolutionise the Payments Landscape

As a robust and highly flexible white label remittance platform with a stronger security architecture and a greater governance, risk and compliance framework embedded.

Comprehensive

Admin Center

Admin Center

NetRemit Admin Centre provides money remittance business users with a full air traffic control style platform that gives the power to configure and control

- Business rules and validations,

- AML limits, Fraud screening parameters,

- EDD metrics,

- Geo-location-wise grouping,

- User access control,

- Transaction routing, repairing and re-rerouting,

- Secure messaging,

- Exchange rates,

- Partners

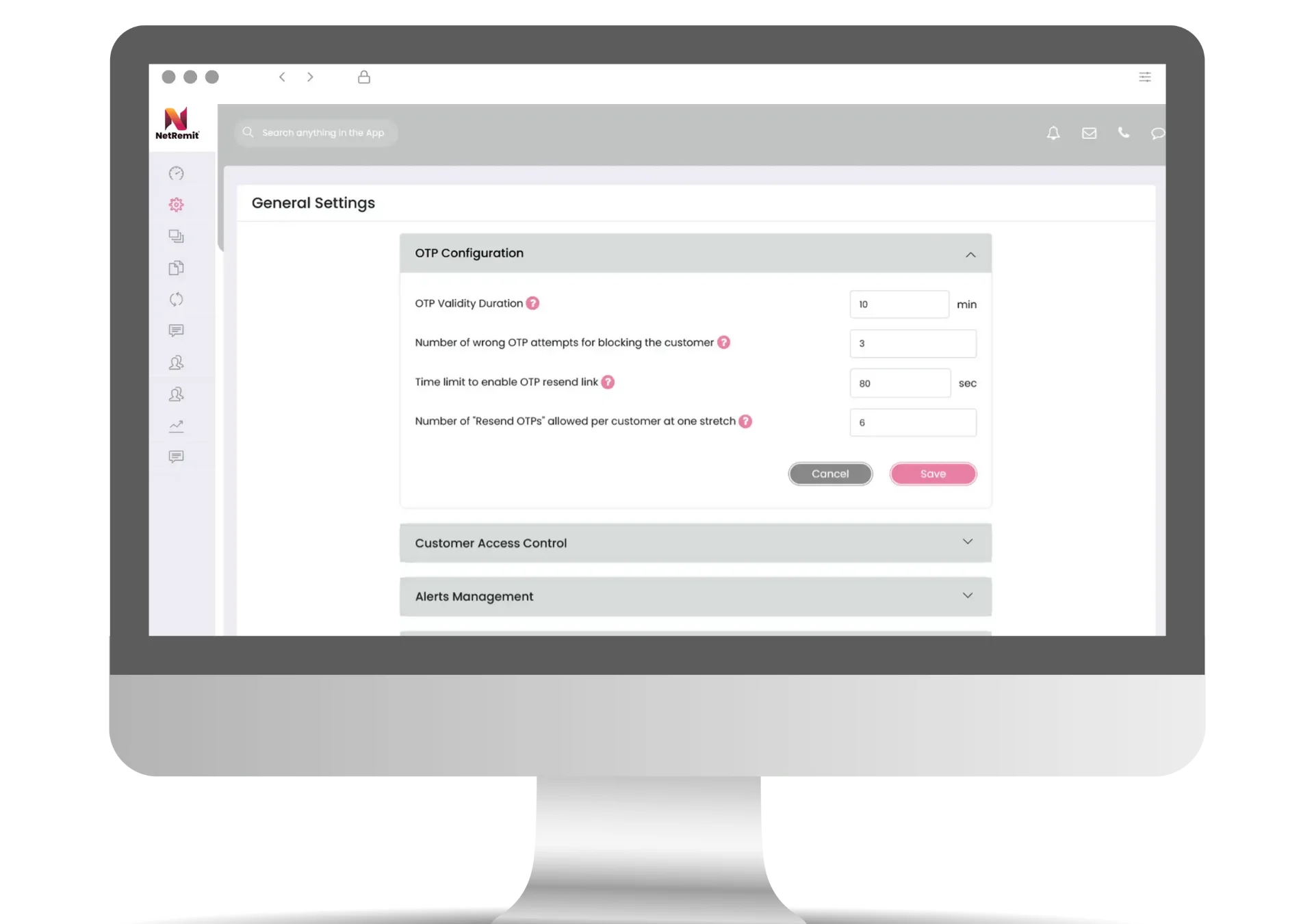

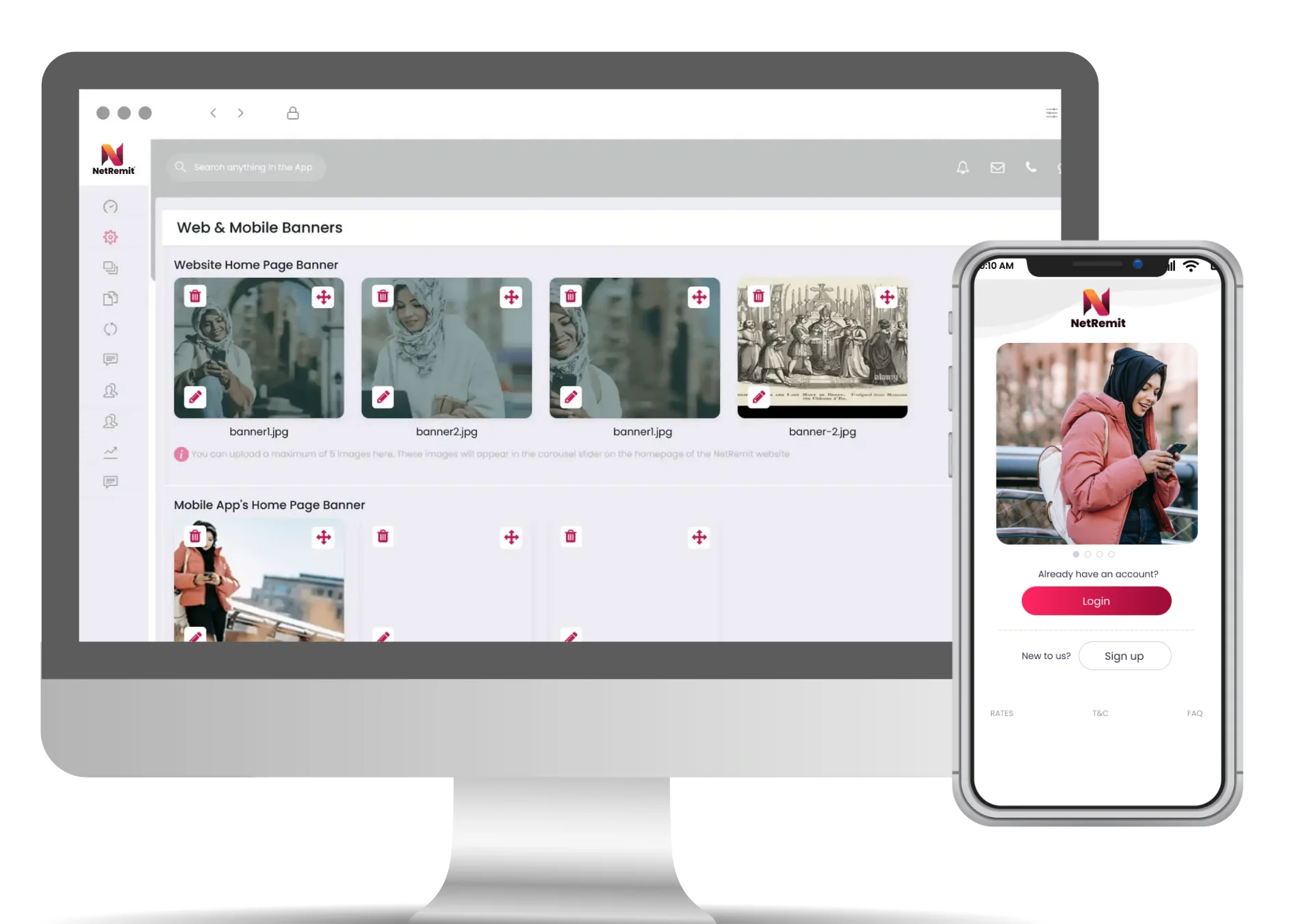

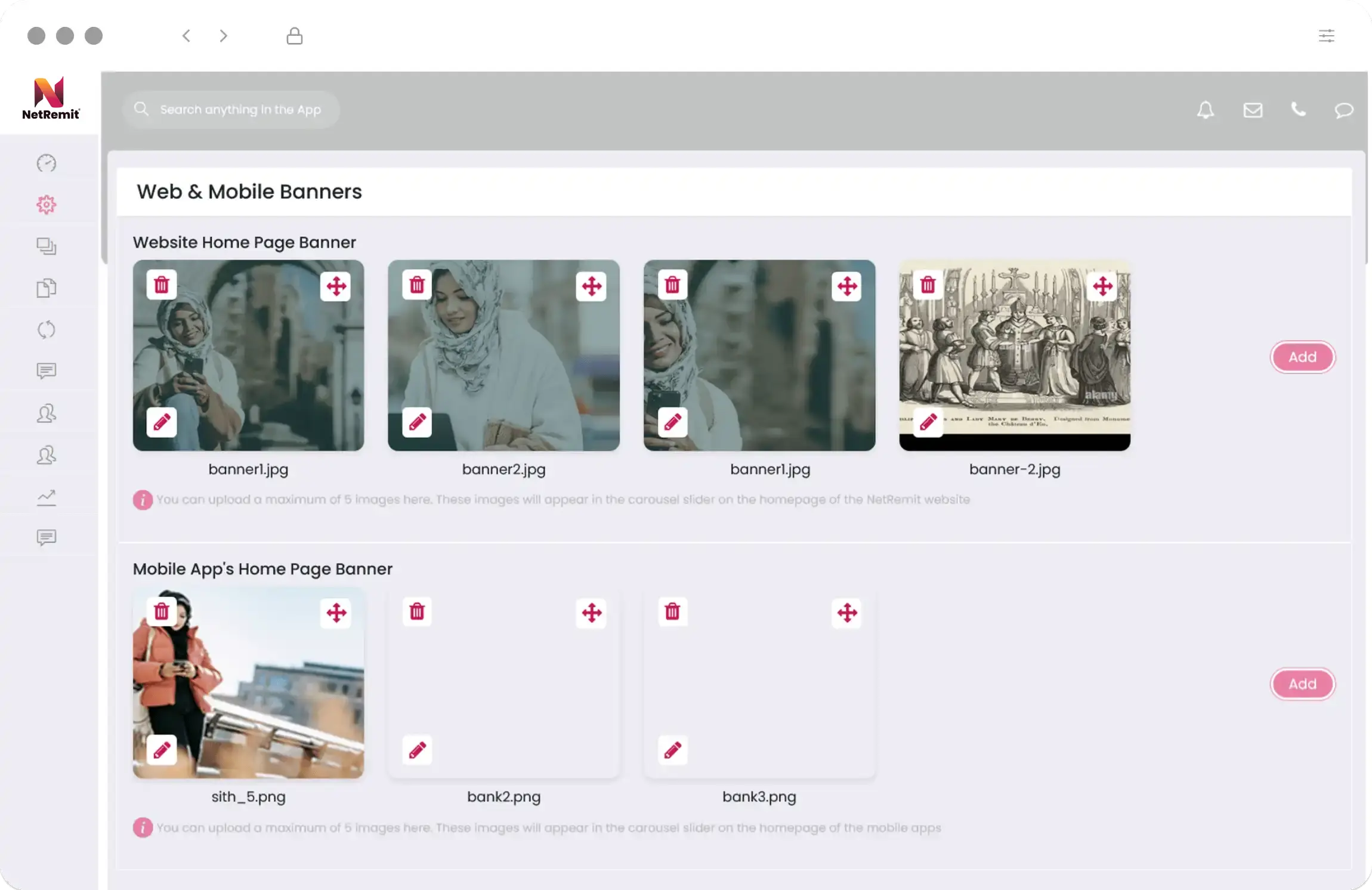

Simplified

Platform Configuration

Platform Configuration

Manage your customer-facing web and mobile applications effortlessly.

- Extensive control to restrict IPs, schedule and run batch jobs, easily manage the app versions, and configure alerts.

- CMS style control to manage the website and mobile app content.

- Option to switch on and switch off your customer portal.

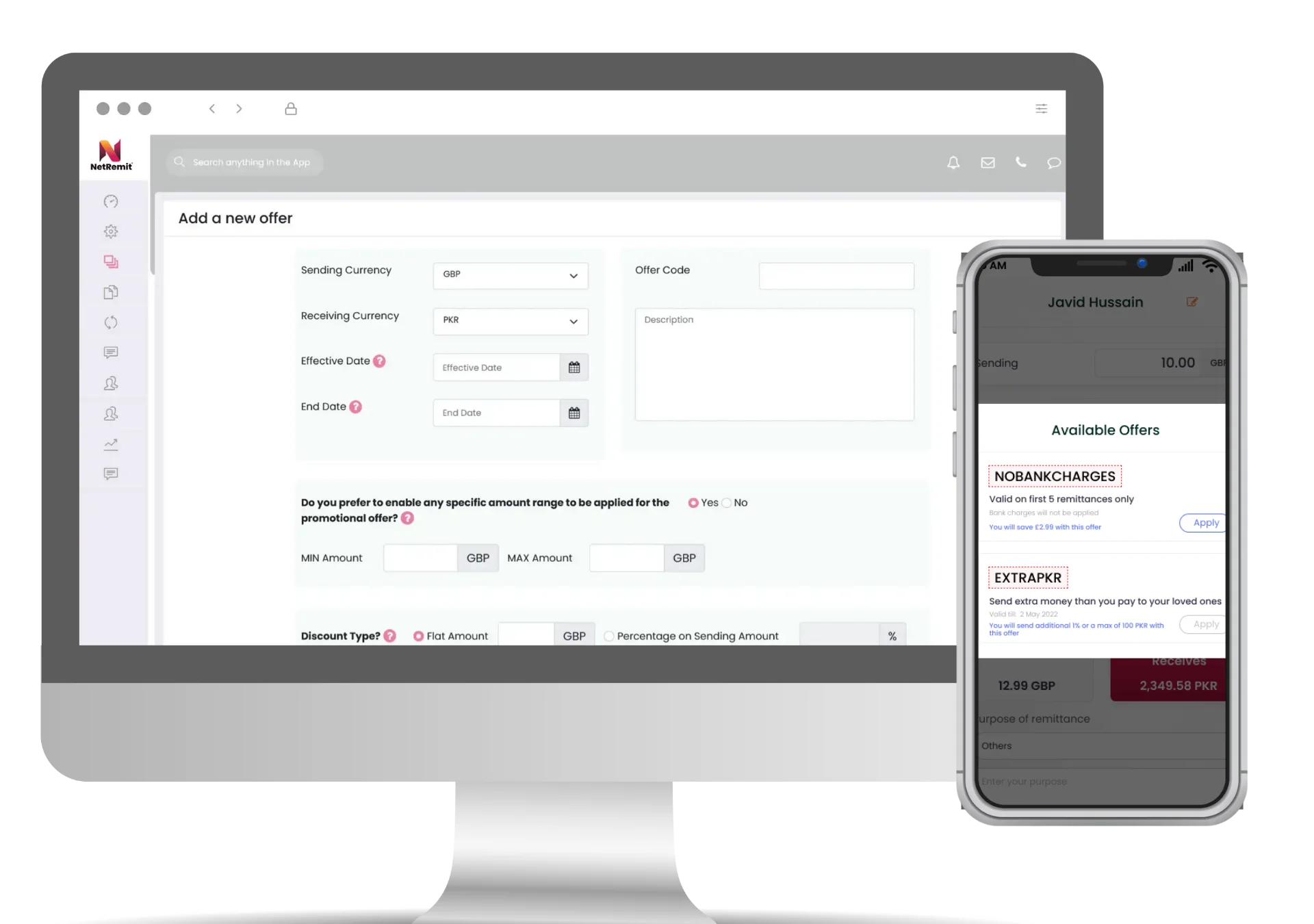

Manage Promotions &

Loyalty Campaigns

Loyalty Campaigns

Detect churn signals early and personalise every customer interaction with a balanced, empathetic approach to build loyalty and maximise retention.

- Design, launch, and manage targeted marketing campaigns directly within our white label international money transfer platform.

- Create engaging promotions, and loyalty programs that keep customers excited.

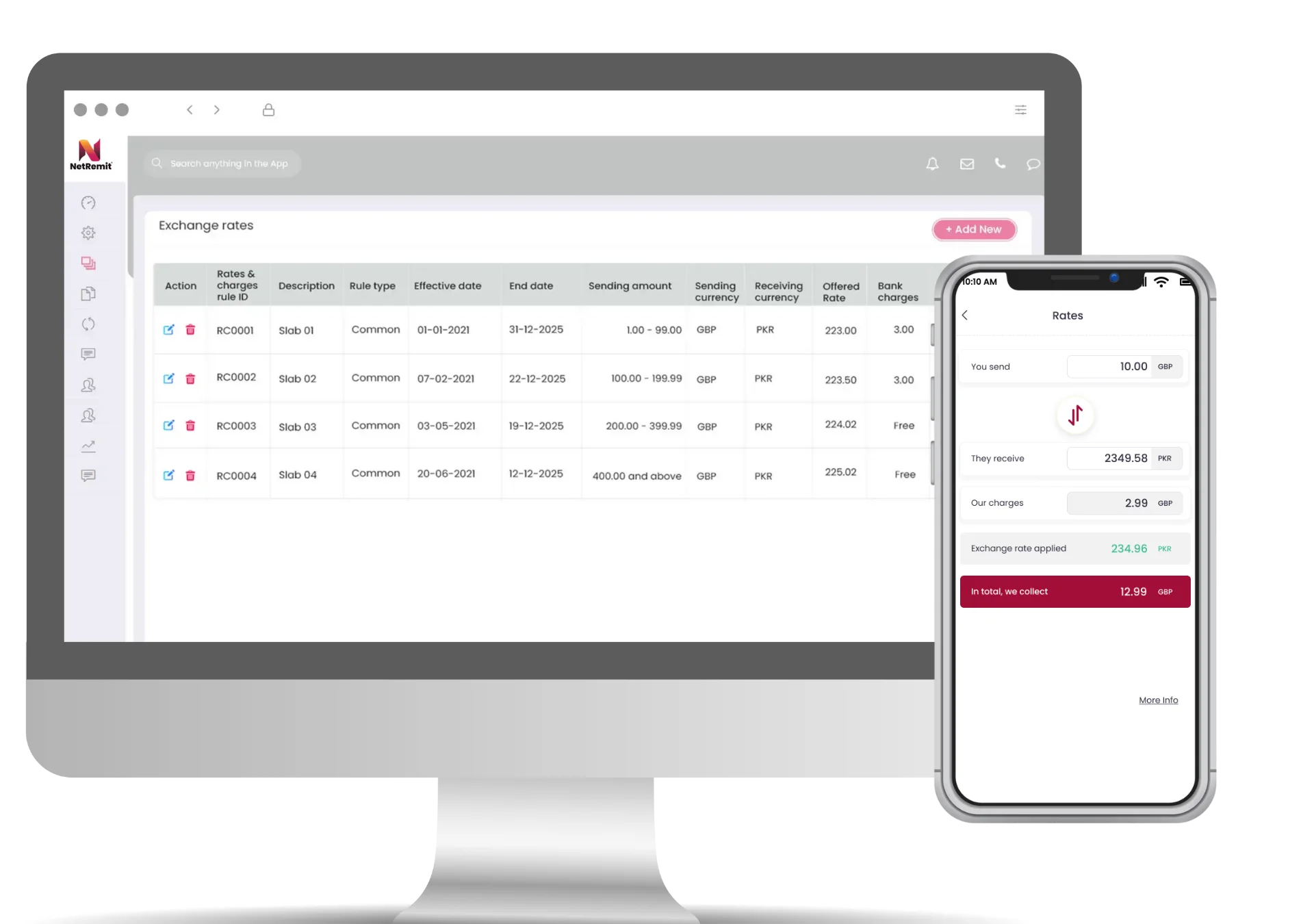

Manage Multi-currency Corridors & Exchange Rates

Scale, automate, and boost your profitability faster without any disruption as your business grows.

- Configure any combination of receiving and payment currencies.

- Manage multiple competitive exchange rate slabs to offer preferential treatment to your customers.

A Comprehensive Money Remittance Software Built by Professionals Who Have Been in the Global Payments Industry for Two Decades

Boundless FinTech

Marketplace Integration

Marketplace Integration

NetRemit provides you with the flexibility to access all leading marketplace apps starting from KYC checks, payment gateways, FX to pay-outs and your core banking systems for a frictionless payment experience ensuring:

- Enhanced compliance with faster payment processing

- Efficient straight-through processing for real-time data exchange

- Robust reconciliation for improved financial control

We handle everything from partner integrations, product/API upgrades, billing, compliance, and more, providing exceptional value, reducing costs and guaranteeing a quick return on investment.

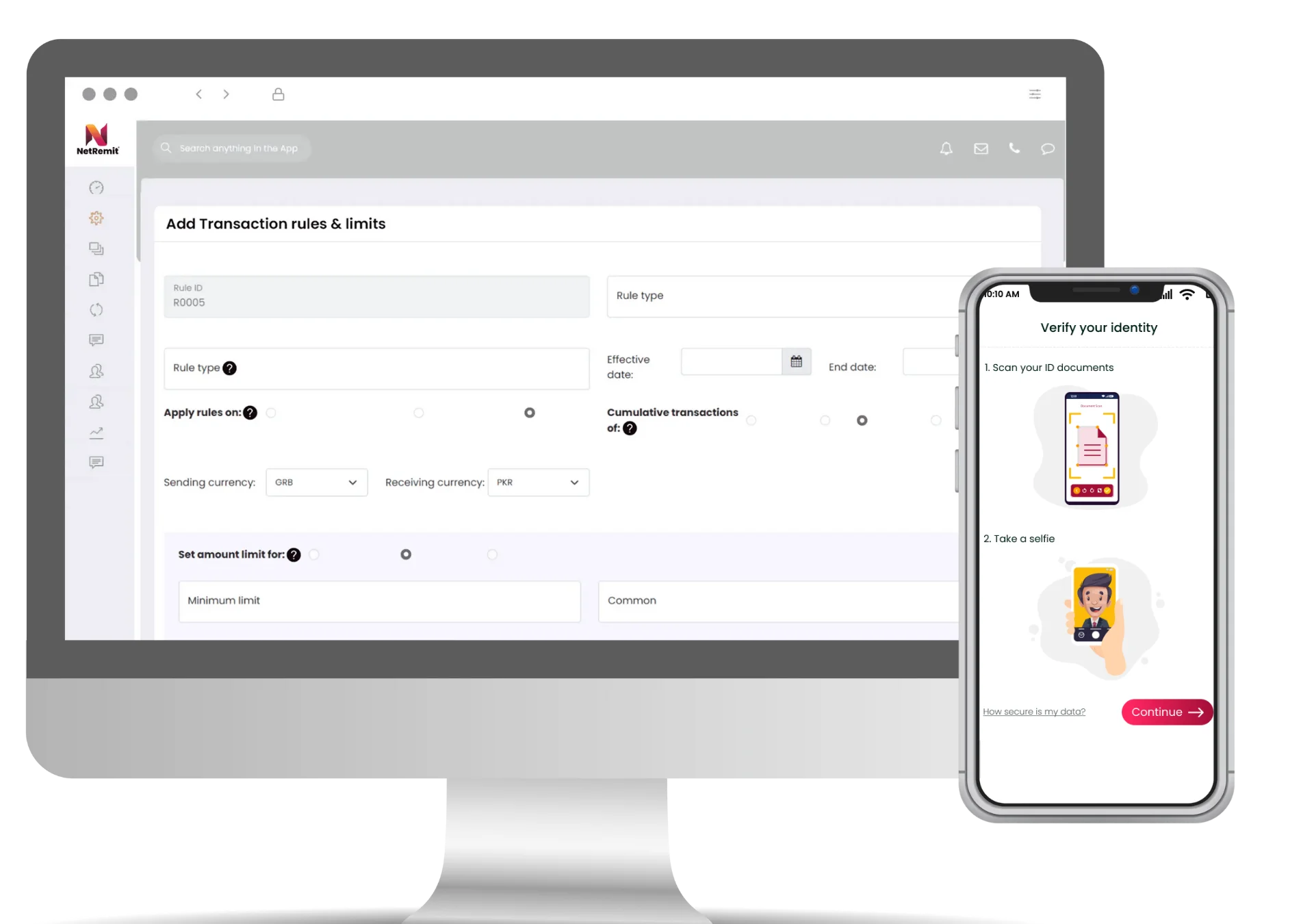

Advanced

Compliance Management

Compliance Management

Accelerate customer onboarding with robust AML/KYC and prevent financial crime through enhanced transaction monitoring and rule enforcement.

- Build your own customer onboarding journey for faster onboarding while ensuring global compliance standards.

- Set up transaction rules and limits to detect suspicious activities like structuring and smurfing.

- Validate beneficiaries and track transactions for potential fraud and red flags.

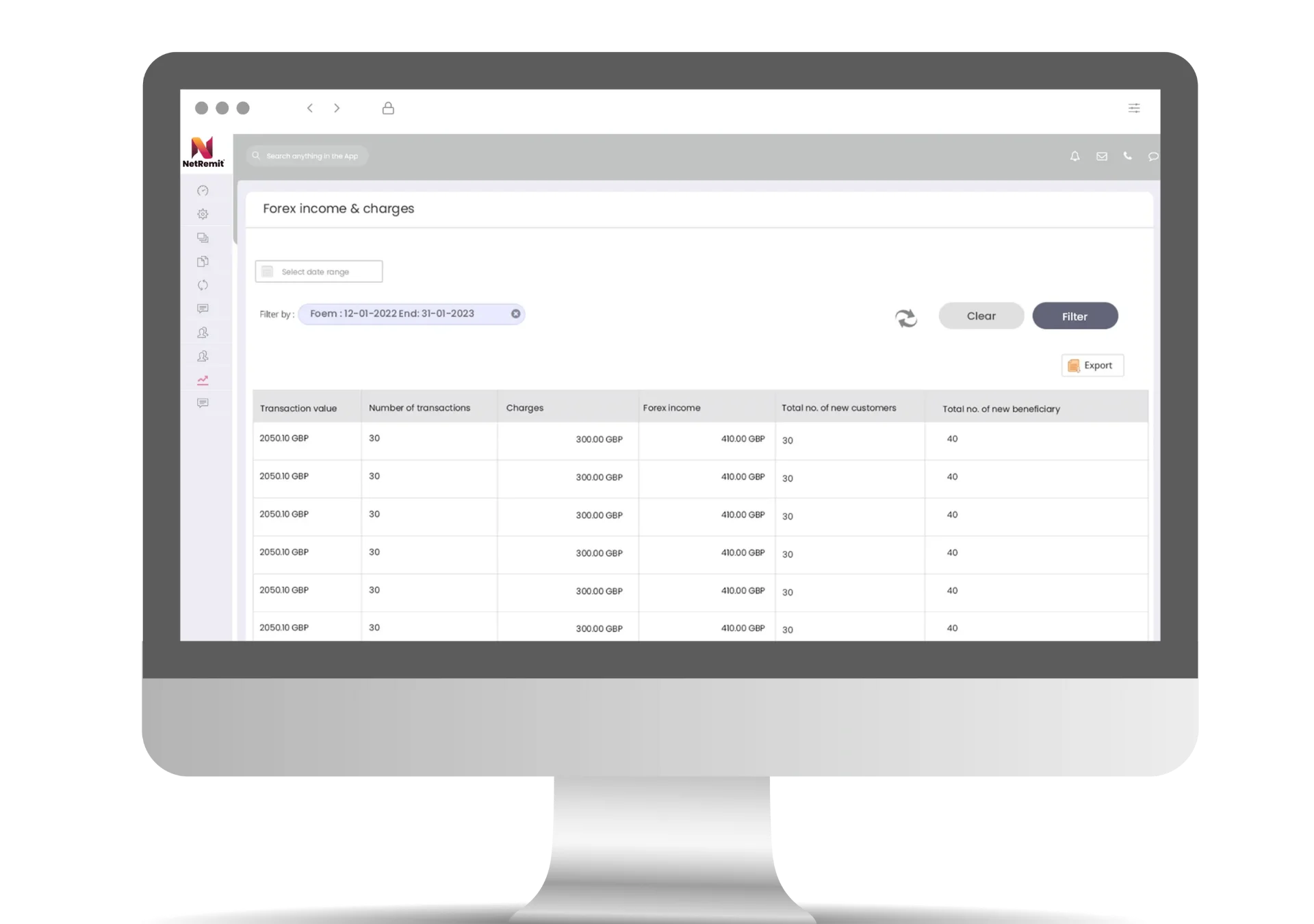

40+ Data Rich

Reporting & Analytics

Reporting & Analytics

Visualise your cross-border remittance business efficiency that works better for you.

- SSIS & Power BI integration for data mining and extended analytics generates 40+ analytical reports to predict customer behaviour and make informed decisions by analysing key factors like transaction volume, FX commission & operational revenue.

Inbuilt Incident

Management

Management

Make it simpler for your customers and employees to timely resolve any service issues through in-built service management.

- Streamline ticket handling and reduce the time to close for more efficient customer service through secure messaging.

- Intuitive Outlook-style interface, minimizing the learning curve for everyone.

Additional Features

Customer Interfaces - Mobile & Web

- Robust eKYC & Simplified Onboarding

- Access Remittance Calculator

- Customer Profile Management

- Manage & Validate Beneficiaries

- Initiate and Track Payments Live

- Choose Multiple Payment Options - POS, e-wallets, Open Banking, & Cards

- Print, Download receipts

- Set Up Alerts and Favourites

- Comprehensive view of Pending transactions

- "Transfer Again" feature for quick transfers

- Customers have full control over their profile information.

- Push Notifications

- Biometric & 2FA authentication

- Identity management and authentication using SSO through Google and Apple Accounts.

- Customers can choose their preferred mode for receiving OTPs.

Additional Features

NetRemit Admin Center

- Business Data Control Panel

- Flexible Fees configuration

- Multiple FX rate management with margin configuration

- Set Transaction rules and limits

- Build your Customer Onboarding Journey

- Configure Beneficiary Validation

- Configure Payment Methods

- Manage Partners, Beneficiary Banks, and Affiliated Branches

- Manage Customers & Transactions

- Manage Compliance

- User/Group Access Control

- Maker Checker to Authorise & Review

- Customer Behaviour Analytics

- TPP Health Check Monitor

- Swift, Nostro/Vostro Interfaces

- Extensive audit trials and logging platform with detailed event tracking, tracing and reporting

Plus, more exclusive features.

Offering Cross-Border Remittance Software With Transparent, Growth-Friendly Pricing, With No Hidden Fees or Surprises

Our international money transfer software pricing scales with your transaction activity, so you are always aligned with actual usage.

Premium

Suits for Startups & Mid-size Enterprises

with Single Branch

Includes White label Cross Border Remittance Platform – NetRemit with third-party integrations, shared hosting, support and go-to-market consulting services.

Enterprise

Suits for Large Enterprises with Multiple Branches & Agents

Includes White label Cross Border Remittance Platform – NetRemit with third-party integrations, unlimited currency corridors, dedicated hosting, extended helpdesk and level 2 technical support and go-to-market consulting services.

Our Platform & Service - Your Brand. White-Label International Remittance Software for Your Ever-Growing Need

With our white label remittance software system, maximise your success rate and stand out from the competition by delivering a market leading cross border remittance service to your customers. All under your brand name, leaving fulfilment to us, you can focus on your core business growth.

Go Live in Few Weeks

Accelerated & controlled delivery. Start your international money transfer service and go-to-market in weeks and not months.

Guaranteed Uptime

24/7 uptime with multilayer business continuity arrangements. Supporting your growth every step of the way.

Cloud-Based

No infrastructure needed. All-inclusive one simple SaaS pricing model. We can manage your infrastructure on-demand.

Assured ROI & Recurring Revenue

Retained commission and FX revenues with substantial growth opportunities year over year as the platform enables you to focus on the business.

User-Friendly Customisation

An intelligent platform with readily available API components capable of easily and quickly customising your entire international remittance process.

Flexible Architecture

Adaptable micro services with future-proof technology for ever changing market conditions and maximise deployment velocity with no disruption in services.

A Regulatory-Grade Remittance Software Enduring Commitment to Data Security and Compliance

Our white-label remittance platform NetRemit is compliant with all key industry regulatory requirements on security, data privacy, cyber threats and endures frequent internal and external audits and remediation.

Data Security & Encryption

Controls

- Robust 256-bit encryption

- Asymmetric AES with RSA / Diffie–Hellman key exchange

- Secure data capture

- SAS, EIT, EAR encryption standards

- JWS for secure packaging & update management

- GUID implementation for unique, tamper-proof identification

- SOAP API services with secure encoding

- Microsoft Enterprise-grade Security

Application Security & Access Protection

- Complies with ISO & OWASP security standards

- Parameter-level validation to prevent injection attacks

- Behaviour-based security CAPTCHA

- URL copy prevention

- 3D Secure authentication

- Latest MVC framework security standards

- Strong customer authentication

- Session management to prevent hijacking

- IP restrictions for the Admin Portal

Network & Infrastructure

Security

- SAS, EIT, EAR, NLC and multi-layer firewall protection

- Physical and Web Application firewalls

- Malware protection

- Periodic VAPT (Vulnerability Assessment & Penetration Testing)

- Secure authentication and access control

- Resilient hosting environment (implied by enterprise-grade setup)

Governance, Compliance & Data Handling

- Stringent data retention policies

- Compliance with ISO security frameworks

- Compliance with OWASP secure coding practices

- Admin-level access restrictions

Remittance Technology as a Service (RTaaS)

Simplify processes to cut expenses and improve customer experience. With Macro Global's industry expertise and partner ecosystem, businesses can ensure that their existing complex cross-border remittance process can be streamlined and fully compliant.

Go-to-Market Consulting

We help you simplifying the complexities of acquiring MSB licensing, banking partnerships, and developing a winning go-to-market strategy, so you can launch your business faster quickly and efficiently.

Growth Consulting

Expand your remittance operations by entering new corridors by accessing our instant payout partner ecosystem which supports 140+ countries including all types of instant, real-time, same day or T+1 payouts.

Compliance Management

Our expertise ensures you meet evolving AML/KYC and CFT regulations, proactively implementing safeguards to minimise risks and ensure your remittance process adheres to the latest standards, lets you operate with confidence.

BPO & Corporate Services

We handle large inward and outward bulk payments, transaction monitoring, processing, reconciliation, and customer support for businesses of any size, delivering exceptional service to your customers.

Legacy Migration Support

We do gap analysis, plan the system architecture, and ensure a smooth transition of your legacy solutions into the leaner more agile international remittance software system of the future, NetRemit.

Cloud Managed Services

We handle the complexity of IT infrastructure, back up your data on several BCP availability zones with business continuity strategies, ensuring the most reliable cloud services you will ever have and always on.

Smart Integration That Increases Your Revenue Stream Beyond Remittance

Maximise your collection of financial services and gain value from our market-leading international remittance software that can be fully customised to match your brand's need.

Mobile Payments

Integration with digital wallets to offer secure, hassle-free, and speedy cross-border P2P payments using the mobile number of the beneficiaries.

Bill Payments

Collaboration with regional EBPPs (Electronic Bill Payment and Presentment) or regional PSPs to facilitate cross-border bill payments across the globe at low costs.

Buy Now Pay Later

Integration with BNPL providers, vendors, and merchants to provide compelling offers to the customers.

Banks, MTOs, and Other Financial Institutions Built a Modern, Efficient, and Customer-Centric Digital Experience Through Our Software

Still Not Convinced? Hear What Our Clients Say

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Previous

Next

Remittance Knowledge Base

FAQs About the Best Remittance Software - NetRemit

Can NetRemit serve B2B cross-border payments?

Yes. The product has been conceptualised, designed and architected keeping B2B in mind. It’s an out-of-box remittance software with highly generic module for easy customisation for any businesses to reflect their brand characteristics.

Do you include a PI, EMI, MSB or Money Transmitter licence along with your white label international remittance software?

As a fintech, we offer robust white label cross border remittance software, NetRemit, which is fully customised as per your brand guidelines and other required integrations for AML/KYC, payment networks, payment gateway, FX, pay-outs and SMS services.

We don’t offer you a remittance license. For new entrants, we provide you with expert consulting services that empower you with all technological and compliance aspects to acquire necessary licenses and partnerships quickly.

Does NetRemit store customer PII information?

NetRemit does not store any personally identifiable information (PII) of your customers. This ensures the highest level of security and privacy.

Does Macro Global or NetRemit collect and hold customer money?

We Macro Global, are a pure SaaS fintech company, providing fully compliant, future-proof remittance technology with necessary integrations to enable remittance service providers to run their international money transfer business seamlessly. We never collect and hold customer data or customer money.

If I migrate to NetRemit Software from other cross border remittance software providers, will I lose all my data?

No you won’t lose the data. Our SME’s and Product team would assist you to carry out a gap analysis on your existing platform with NetRemit and provide you a detailed plan of staged migration using pre-built scripts with closely linked reconciliation. This phased implementation will ensure the data integrity and confidence through multiple sample drill before the live roll out to ensure you are comfortable.

Does your platform provides Maker/Checker facility and how it helps the business to control key impactful area of the operations?

A change in the exchange rate, compliance rule, transfer limits or whatever change a user wants to make needs to be requested and further authorised by two different users who have been given access, privilege and authority. This will be defined during the user creation with a module control which allows the inputter to request for a change with a comment. The authoriser will review the requested update popped up in their queue and approve or reject it. This is quite well linked so without the four eyes none of the key impacted requested will be approved. This granularity of imposing the four-eye principle can also be controlled through the back-end platform.

Will the same platform help manage branches and the online portal?

Yes. You can use the same platform for your normal customer access and for your branch users to serve walk-in customers.

How does third party integrations work with NetRemit?

Our product & business team will work with your project team to identity the key integration requirement which would be part of the “engagement scope” and ensure agreed TPP platforms are brought into the delivery scope from onboarding through go-live. Our PMO team will assist you and all the stakeholders throughout the journey to ensure your integration successfully, leaving no gap or slippage.

Do we have access to manuals and training?

Yes. We have a comprehensive Knowledge Base Platform that provides full-scale, border and wider articles that help to learn every detail about NetRemit product.

Can we track payments in real time through this money remittance software?

Yes. The platform provides you wide range of status at every stage of remittance journey either through push notification or you can log in to the mobile platform and select -> Track my Remittance to know where exactly the transaction as part of the journey.

Who is going to be the owner of data related to the customer and transactions?

White-labelled International Remittance Software, NetRemit, will be hosted on a secure cloud server with a stringent data governance and retention control framework, which includes the production and recommended disaster recovery environment. This ensures 99.99% uptime.

Alternative to the above, if the remittance software is hosted in the cloud tenant owned by Macro Global, then the ownership of data related to the customer and transactions will be with MG, adhering to the client’s internal data handling regulations and UK and international data regulations strictly adhered to.

In both cases, Macro Global can offer the managed service offering to maintain the security and upkeep of the platforms.

How are we ensuring data security on transit and rest?

We ensure a high-level depiction of data security; all the requests and responses will be encrypted utilising PGP keys to ensure the data in transit gets encrypted. The same PGP key will be stored in the Azure key vault where it will be utilised to encrypt the data on rest.The data transit between every hop further adhered with the MVC IAM framework where authentication and authorisation are enforced at every request/response.

Can the clients have offline backups of customer and transaction data periodically?

The NetRemit Admin Center (NAC) has the exclusive provision to export the customer or transaction details anytime on an ad-hoc basis. Moreover, as part of the BCP the data will be synchronised to another identical server both with zone- and geo-redundant storage and the ability to restore backups from a paired region at any time.

Our technical support team provides a detailed demo on this to the respective stakeholders on BSAU activities while customer onboarding.