© 2025 Macro Global. All Rights Reserved.

FSCS SCV REGULATORY REPORTING SOLUTION

A Proven FSCS SCV Audit Reporting Software for Unmatched SCV Accuracy & Compliance

SCV Alliance, the Enterprise-Grade FSCS SCV Audit Platform trusted to enhance regulatory resilience by:

- Delivering Accurate, Audit-Ready SCV Reports

- Reducing Regulatory Risk With 175+ Deep Data Checks

- Strengthening Data Quality, Governance & Traceability

- Guaranteeing 24-Hour FSCS Reporting Readiness

- Preparing You for Future-Ready Compliance

15+

Banks

12+

Years of Product Maturity

14,000+

Client Audits from year 2010

2,000+

Audits

175+

Audit Validations

2 Million

Million Validations each month

7+

CBS Integration

10+

External Data sources

15+

Banks trust SCV Alliance

15+

Years of Product Maturity

2 Million

Validations each month

14,000+

Client Audits from year 2010

The £120K FSCS update brings deeper scrutiny. Meet SCV Alliance, your Audit Shield

Built for UK Banks, Building Societies, Credit Unions and other financial institutions, delivering accurate, compliant SCV reporting with reduced regulatory risk.

Delivers High-Accuracy SCV Reporting with Zero Manual Burden

Effortlessly consolidate high-volume data across systems and generate fully compliant, traceable SCV reports that leadership can confidently sign off.

Ensures Consistent, PRA-Aligned “Green Status” Compliance

Gain deep data visibility through multi-level audit validations, avoid costly remediation, prevent audit escalations and maintain consistent FSCS compliant SCV reporting.

Maintains Secure, Always-On FSCS SCV Readiness

Operate with strong security, governance, and operational resilience, ensuring full FSCS 24-hour SCV readiness even during stress events or contingency scenarios.

Does your data comply with FSCS regulatory requirements for 24-hour reporting? Discover SCV Alliance

Fully tried and tested Single Customer View reporting platform to all your challenges around FSCS regulatory reporting, provides

Seamless Data Consolidation

Effortlessly manage and unify large volumes of customer and account data across multiple systems. Enable smarter decision-making and generate accurate, FSCS compliant SCV reports with ease.

Unmatched Data Accuracy

Leverage AI-powered validations and automated controls to eliminate duplication, correct customer data and account segregations inaccuracies, and ensure fully compliant SCV reports, reducing manual effort and risk.

Robust Data Protection & Compliance

Adheres to ISO standards and FSCS compliance requirements with robust data security throughout the regulatory lifecycle, featuring hierarchical security, advanced encryption, and a complex password mechanism to protect SCV output files.

Banks & financial institutions across the world are building their digital transformation journey through our platforms

Is your SCV ready for the £120k FSCS limit and instant 24-hour reporting?

Ensure your institution meets stricter FSCS and PRA expectations with a deep, expert-led SCV risk and compliance review.

Key Features

10th Gen FSCS SCV Reporting & Audit Software for sharper insights & stronger compliance

Designed to reduce regulatory risk, strengthen audit assurance, and deliver FSCS-compliant SCV outputs trusted by Risk, Compliance, Data, and Audit teams alike.

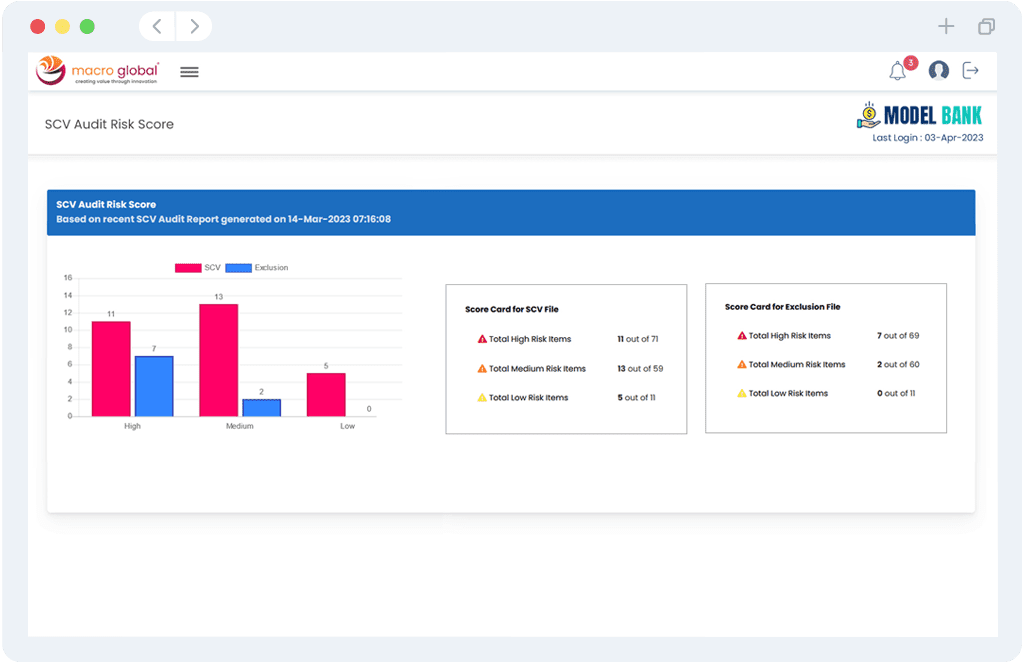

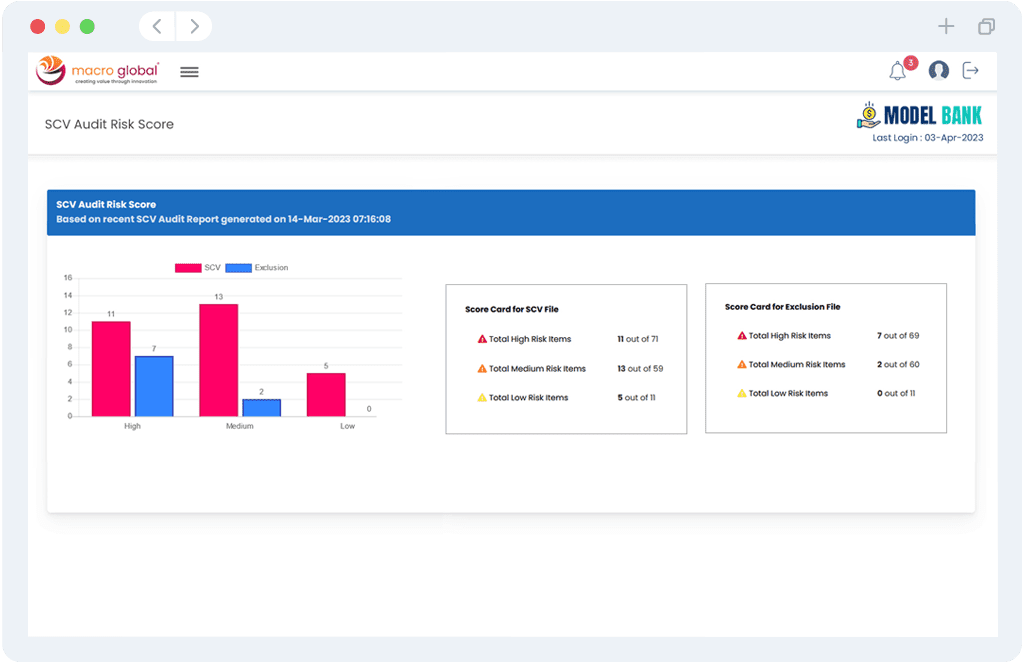

175-Point Audit

Validations

Validations

- Ensure complete confidence in your FSCS SCV reporting with 175+ rigorous data validation checkpoints.

- Our advanced rule engine leverages complex algorithms and external datasets to detect and resolve high and medium-risk data issues, delivering accurate, PRA-aligned reports that meet every FSCS compliance requirement.

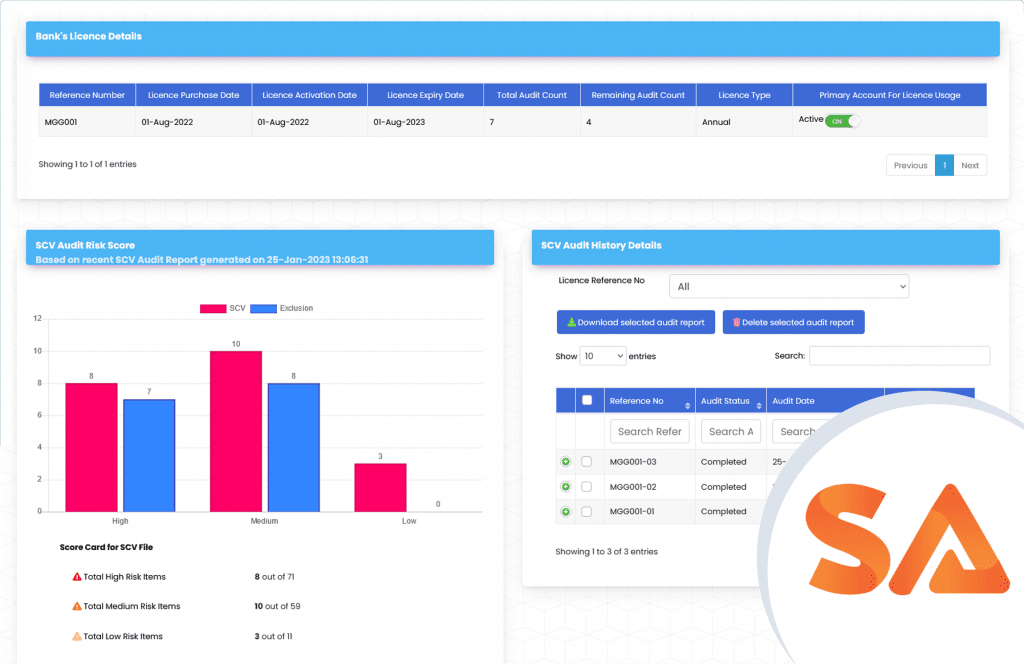

Comprehensive

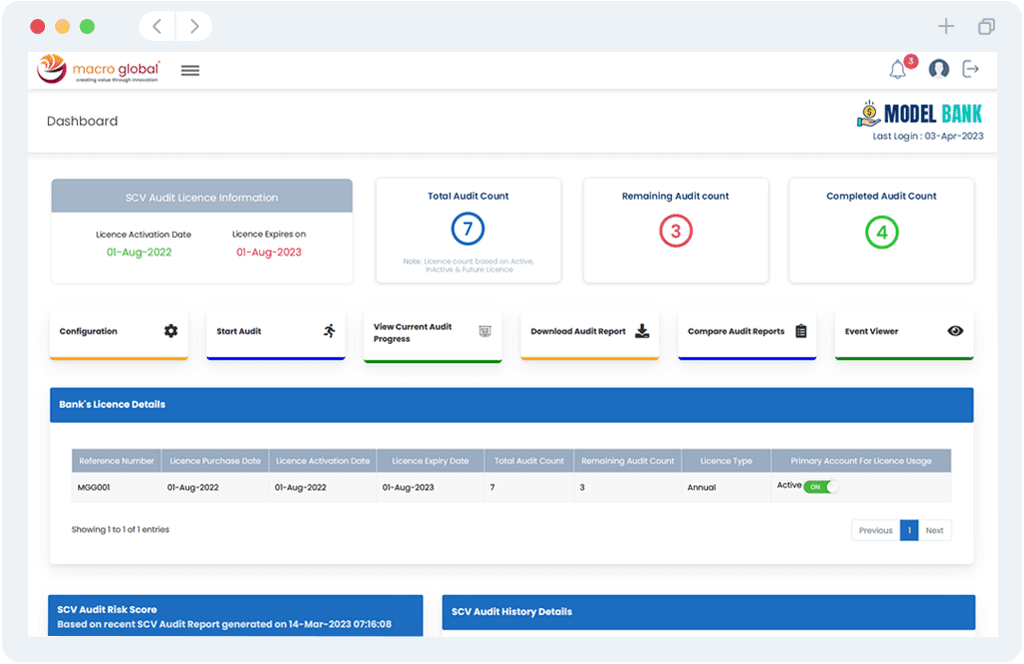

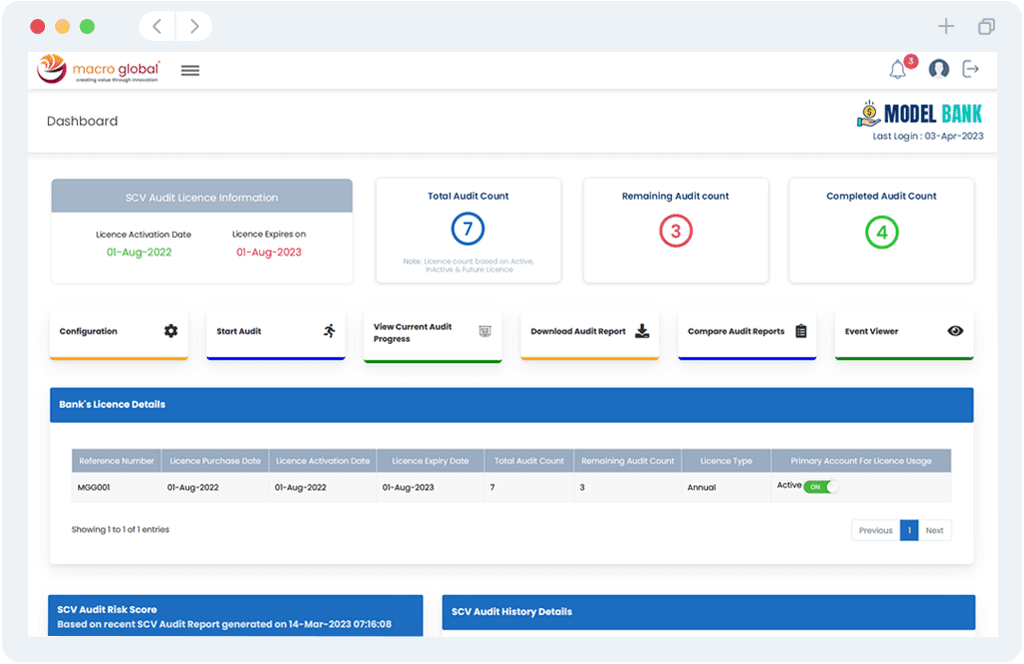

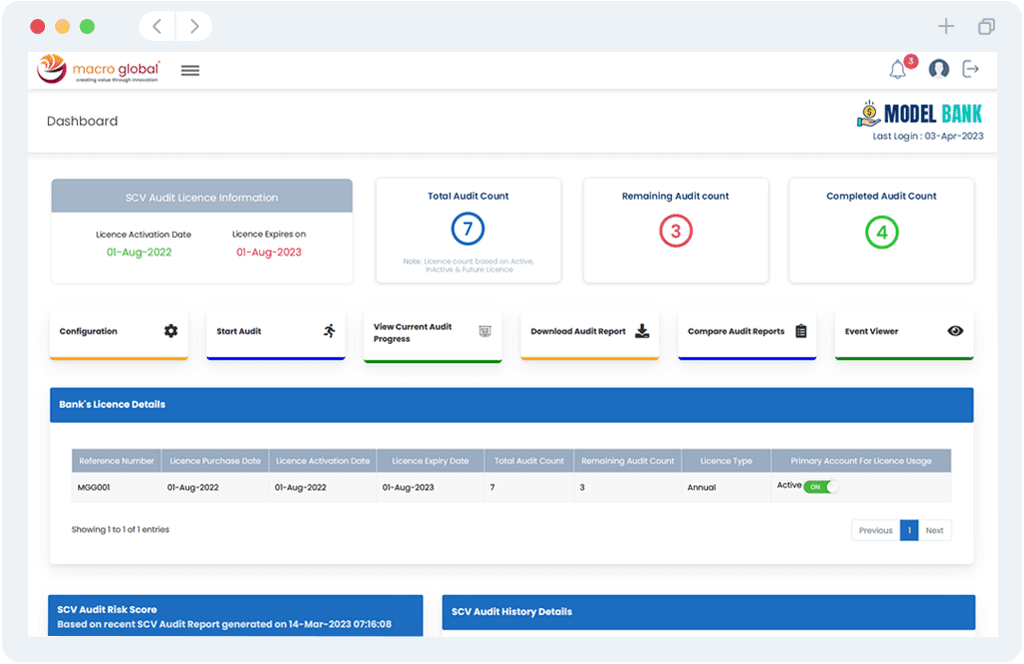

Dashboard

Dashboard

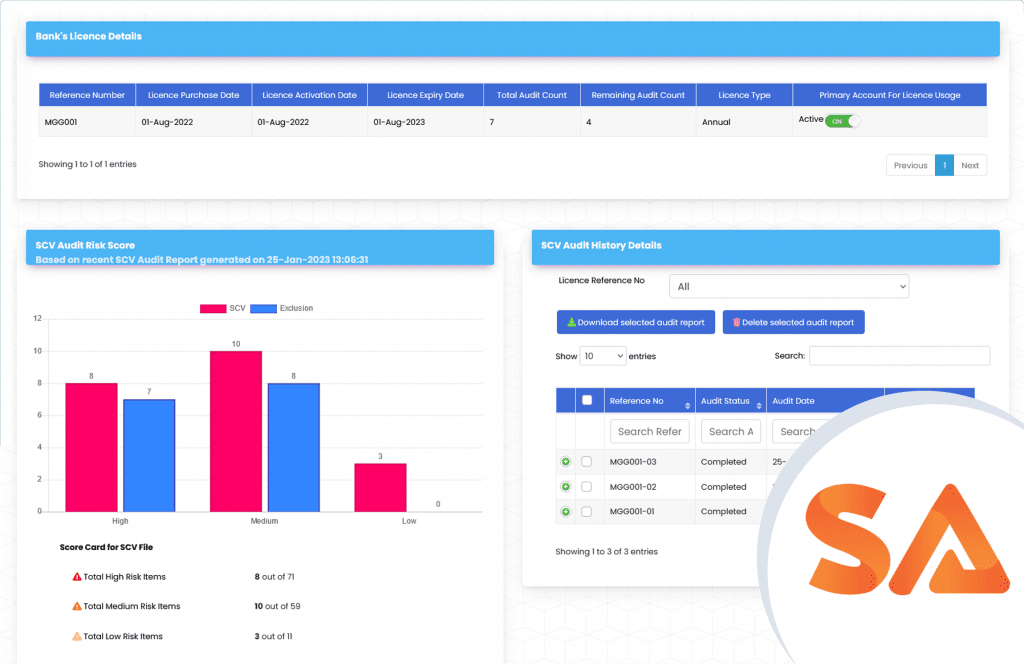

Gain complete control of your customer data with our interactive single customer view dashboard that visualises FSCS reporting status, highlights data issues for deeper insights, and offers instant access to key modules. All in one seamless experience.

Data Rich Reportings & Analytics

- Generate dozens of reports tick every box for FSCS SCV regulatory compliance requirements with deep data mining and extended analytics through seamless SSIS & Power BI integration.

- Generate detailed reconciliation and effectiveness reports to drive data accuracy, improve decision-making, and ensure strong governance across your FSCS compliance lifecycle.

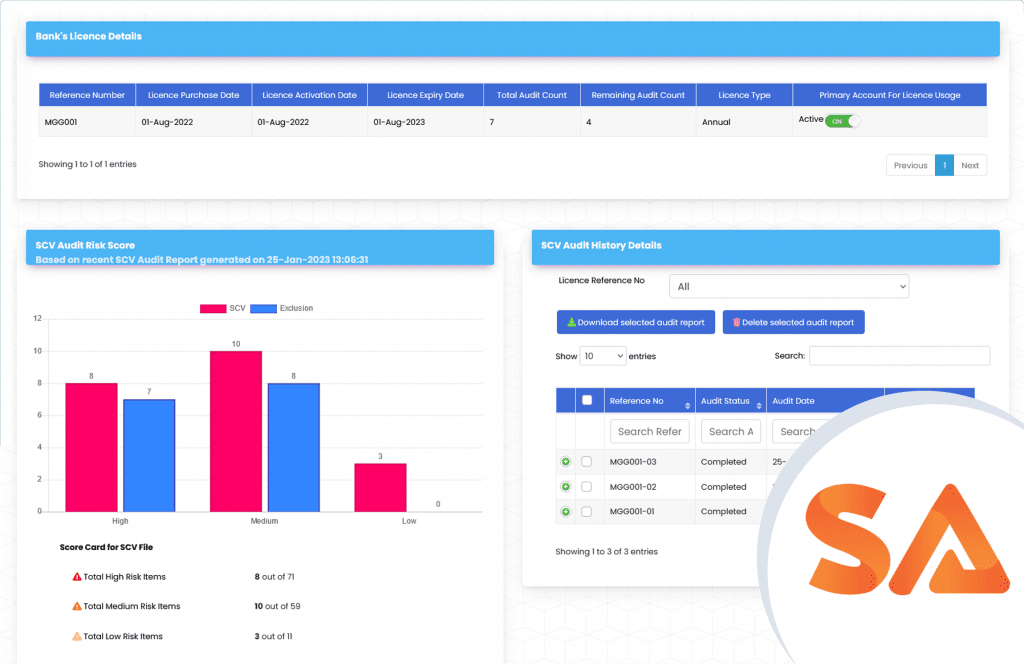

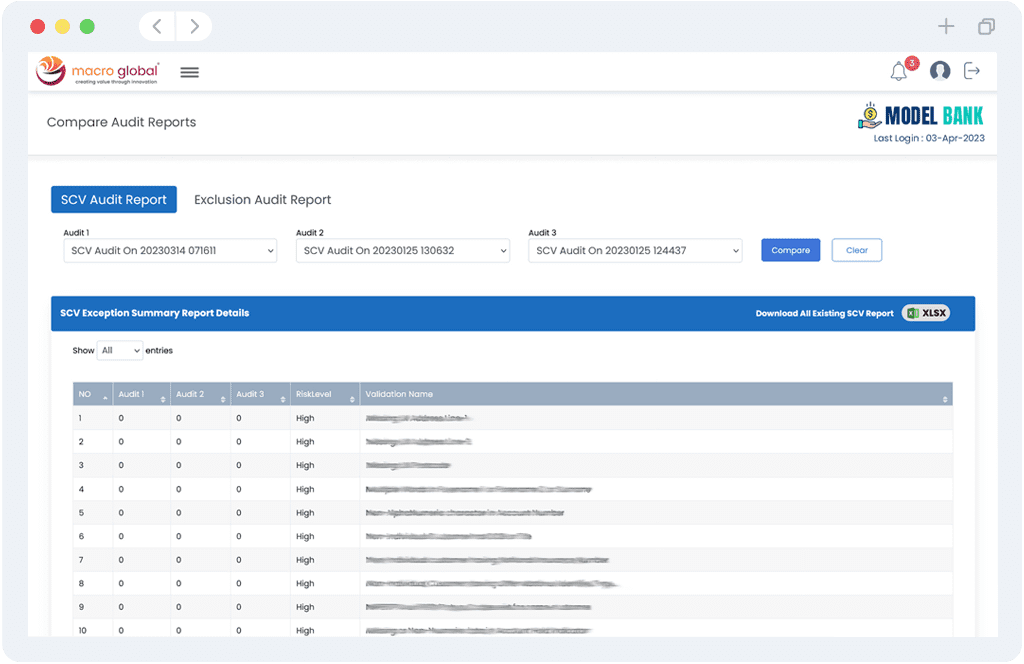

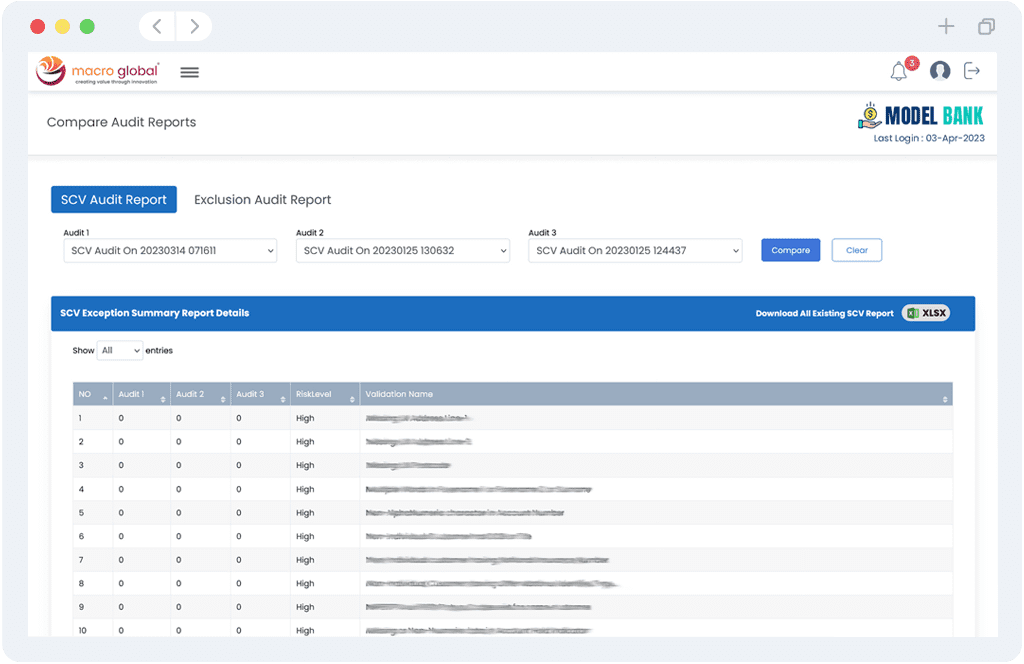

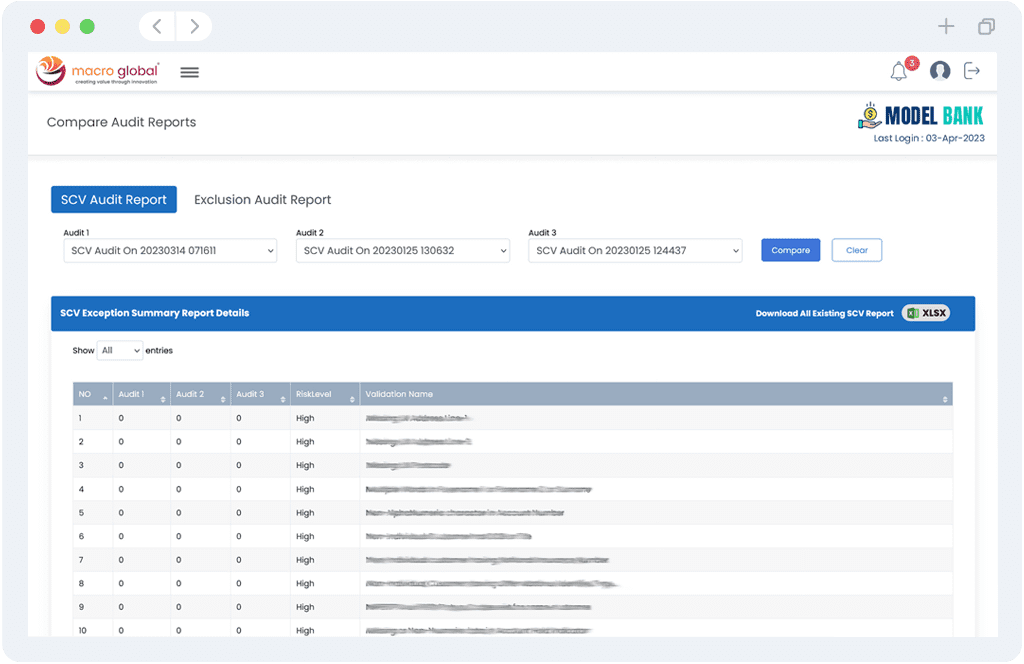

Audit History with

Smart Comparison

Smart Comparison

- Maintain a complete audit history and effortlessly compare past and present audit reports to identify trends, measure data quality improvements, and validate remediation efforts.

- Ensure every FSCS SCV electronic submission to RegData meets FCA’s rigorous compliance standards with confidence and clarity.

175-Point Audit Validations

- Ensure complete confidence in your FSCS SCV reporting with 175+ rigorous data validation checkpoints.

- Our advanced rule engine leverages complex algorithms and external datasets to detect and resolve high and medium-risk data issues, delivering accurate, PRA-aligned reports that meet every FSCS compliance requirement.

Comprehensive Dashboard

Gain complete control of your customer data with our interactive single customer view dashboard that visualises FSCS reporting status, highlights data issues for deeper insights, and offers instant access to key modules. All in one seamless experience.

Data Rich Reportings & Analytics

- Generate dozens of reports tick every box for FSCS SCV regulatory compliance requirements with deep data mining and extended analytics through seamless SSIS & Power BI integration.

- Generate detailed reconciliation and effectiveness reports to drive data accuracy, improve decision-making, and ensure strong governance across your FSCS compliance lifecycle.

Audit History with Smart Comparison

- Maintain a complete audit history and effortlessly compare past and present audit reports to identify trends, measure data quality improvements, and validate remediation efforts.

- Ensure every FSCS SCV electronic submission to RegData meets FCA’s rigorous compliance standards with confidence and clarity.

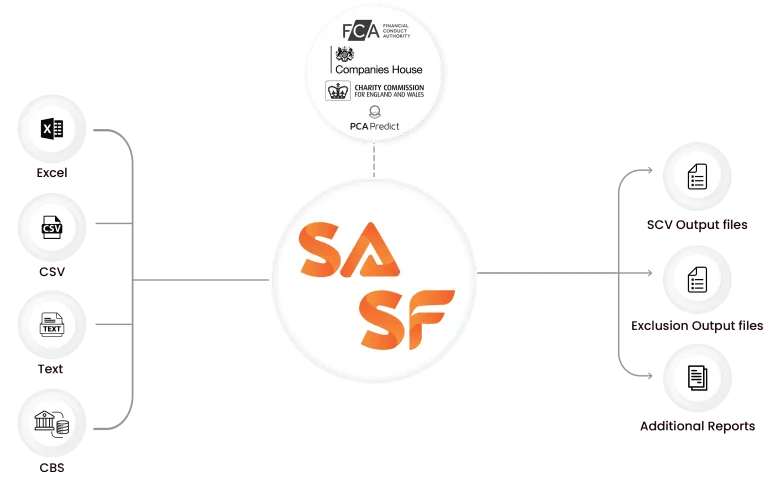

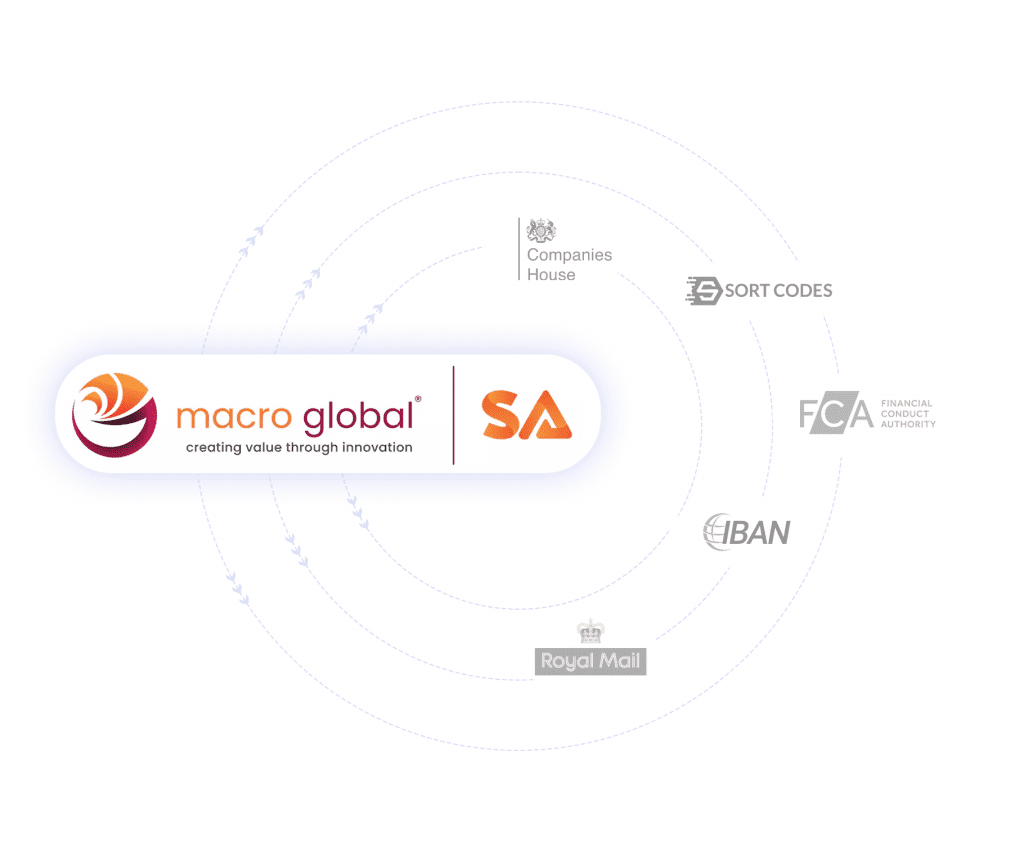

Compliance with Third-Party Data Screening

- Ensure exceptional data accuracy and full FSCS SCV compliance by automatically validating customer data against trusted third-party databases such as FCA DB, Royal Mail DB, Companies House, Charities Register, BFPO Address, and OFAC Sanctions List.

- Minimise risk, reduce errors and stay ahead of regulatory expectations.

Seamless Integration with CBS & External Systems

- Effortlessly connect your core banking platform via our secure CGI gateway, enabling real-time, two-way data exchange.

- Gain an accurate single customer view with automated reconciliation, error handling, and EOD statistics that deliver full transparency and zero surprises.

- Achieve straight-through processing with robust messaging and auto-resubmission for failed transactions—maximising efficiency, data integrity, and FSCS regulatory confidence.

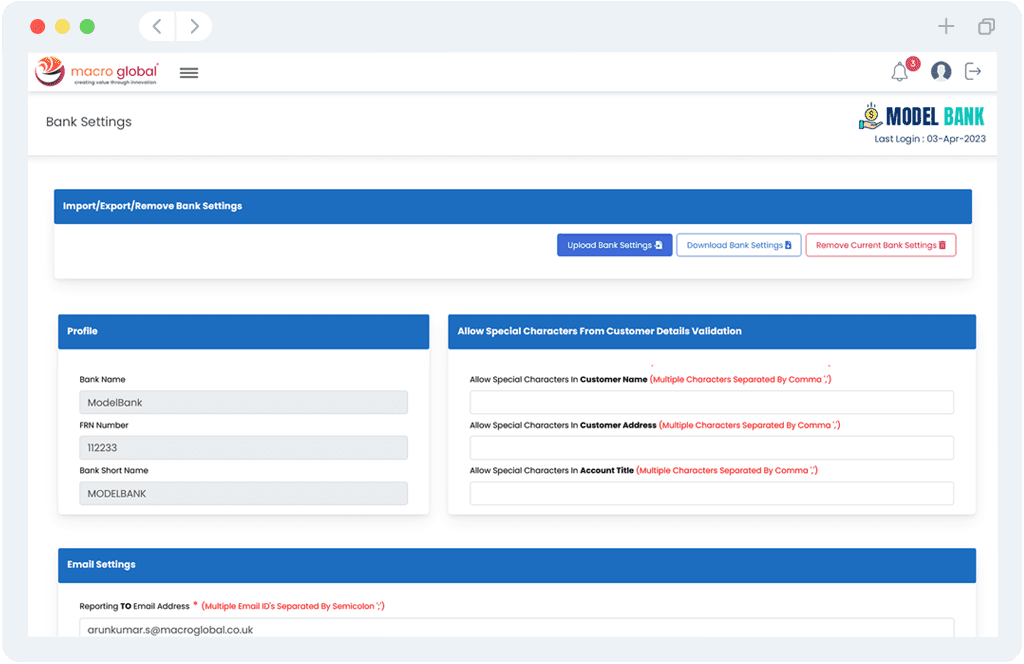

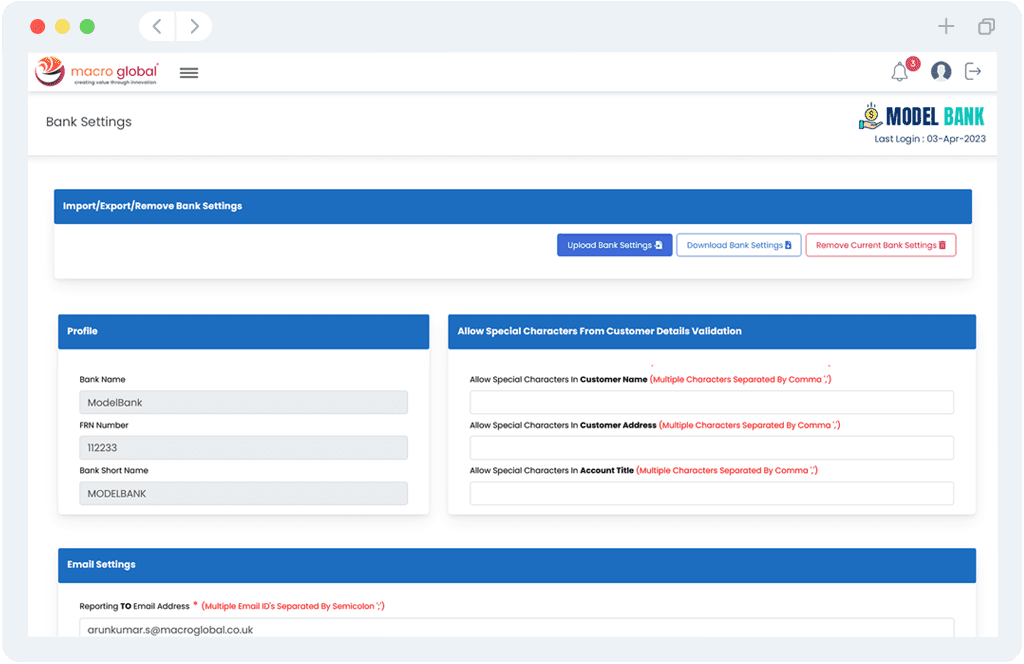

Simplified Bank Configuration & Settings

- Optimise your FSCS SCV audit and reporting with powerful configuration tools. Easily customise bank profiles, manage customer and account data, and tailor validation logic to your business needs.

- Achieve full compliance with FSCS requirements while improving accuracy and reducing risk through advanced algorithms and business rules.

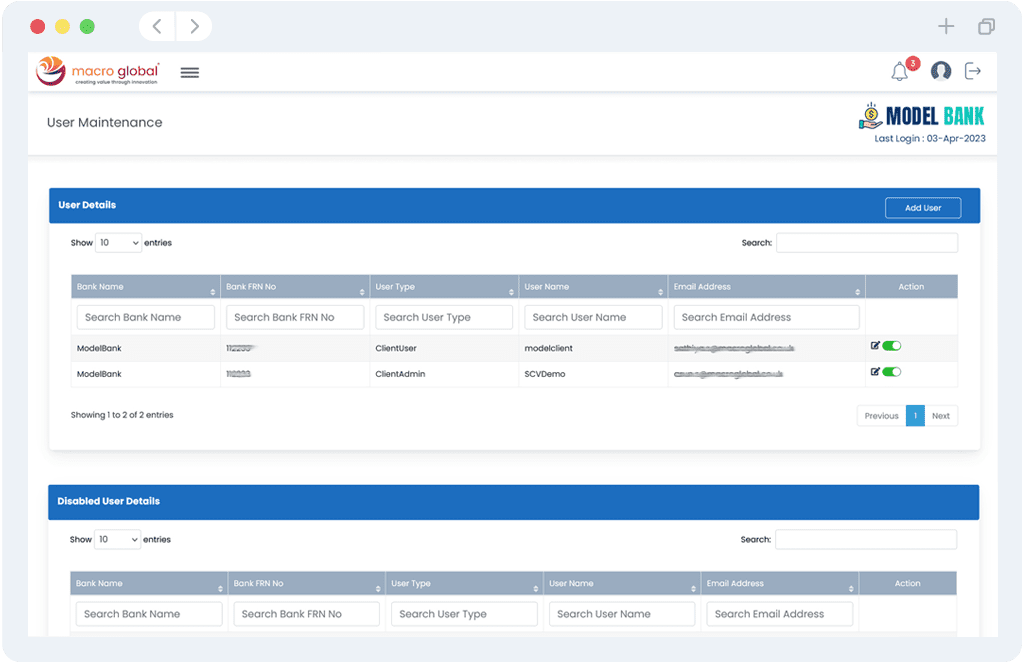

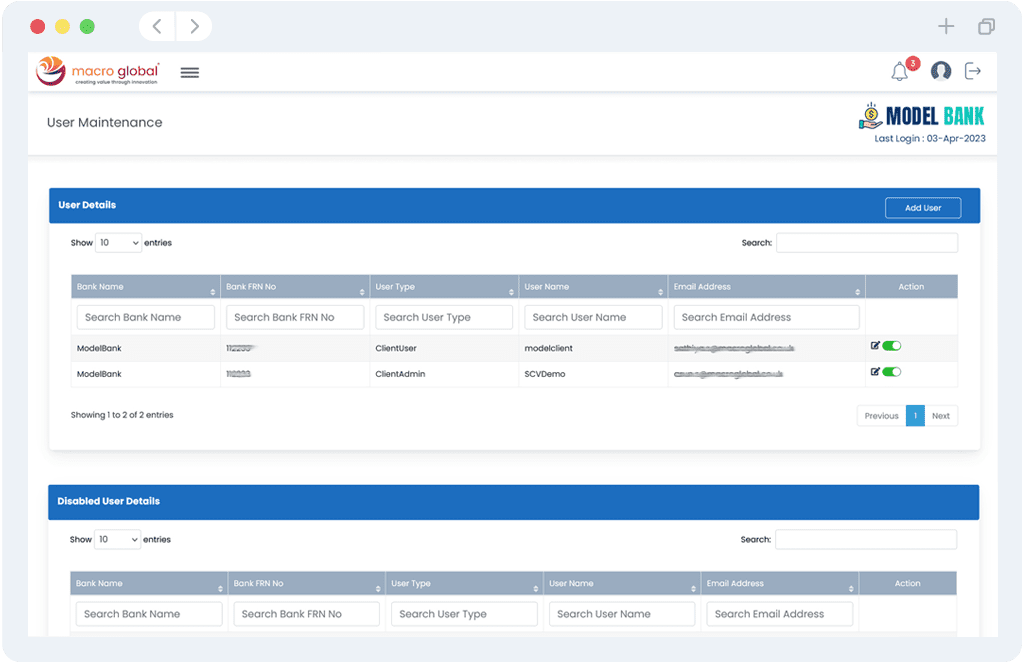

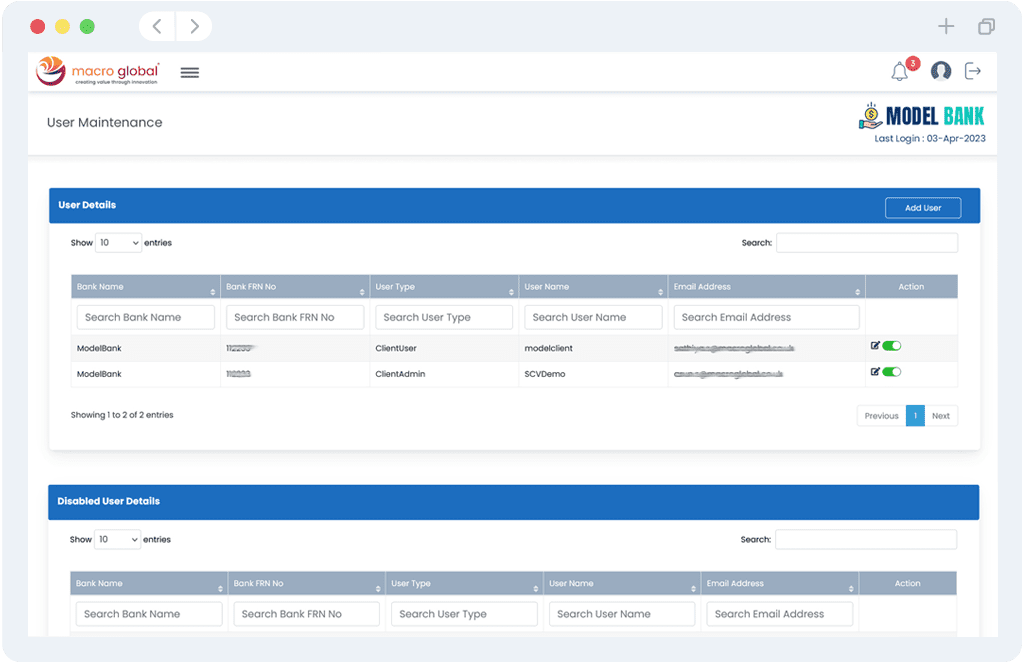

Controlled User and Role

Management

Management

- Easily group users based on your business needs and assign specific roles to the groups through enhanced module control.

- Strengthen data integrity, reduce risk, and simplify permissions management across your organisation with enhanced module controls.

Compliance with Third-Party Data Screening

- Ensure exceptional data accuracy and full FSCS SCV compliance by automatically validating customer data against trusted third-party databases such as FCA DB, Royal Mail DB, Companies House, Charities Register, BFPO Address, and OFAC Sanctions List.

- Minimise risk, reduce errors and stay ahead of regulatory expectations.

Seamless Integration with CBS & External Systems

- Effortlessly connect your core banking platform via our secure CGI gateway, enabling real-time, two-way data exchange.

- Gain an accurate single customer view with automated reconciliation, error handling, and EOD statistics that deliver full transparency and zero surprises.

- Achieve straight-through processing with robust messaging and auto-resubmission for failed transactions—maximising efficiency, data integrity, and FSCS regulatory confidence.

Simplified Bank Configuration & Settings

- Optimise your FSCS SCV audit and reporting with powerful configuration tools. Easily customise bank profiles, manage customer and account data, and tailor validation logic to your business needs.

- Achieve full compliance with FSCS requirements while improving accuracy and reducing risk through advanced algorithms and business rules.

Controlled User and Role Management

- Easily group users based on your business needs and assign specific roles to the groups through enhanced module control.

- Strengthen data integrity, reduce risk, and simplify permissions management across your organisation with enhanced module controls.

Strengthen your FSCS SCV Reporting Accuracy before scrutiny increases

Discover SCV Alliance, an enterprise-grade data management and audit platform, deliver accurate, audit-ready SCV files backed by 175+ deep validations.

How it works?

Achieve accurate Single Customer View reports in 5 simple steps

Collect & Consolidate

Aggregate customer and account data from multiple systems into one complete SCV dataset.

Structure & Enrich

Fix duplicates, correct inconsistencies, and enrich records for a clean Single Customer View.

Validate & Transform

Apply 175+ multi-layer validations, business rules, THB logic, and FSCS eligibility rules to ensure SCV accuracy.

Audit & Assure

Apply audit trails, integrity checks, and external screenings for PRA-ready assurance.

Generate & Submit

Produce FSCS-compliant SCV output files with full traceability, meeting 24-hour readiness every time.

Why Choose SCV Alliance?

Purpose-built FSCS SCV Reporting & Audit Software for Banks, Building Societies & Credit Unions

Delivering accurate, regulator-defensible SCV outputs, reducing audit risk, and ensuring continuous FSCS reporting readiness.

Stay FSCS Compliant, Always

Continuous regulatory updates keep your FSCS SCV reporting aligned with evolving FSCS and PRA expectations.

Scalable for Any Institution

Enterprise-grade FSCS SCV reporting software built to handle high-volume depositor data, multi-system integrations, and growing portfolios.

FSCS Expert Consulting

Gain a competitive edge with actionable insights that strengthens audit outcomes and reduces regulatory risk across every SCV cycle.

Avoid Penalties, Ensure Accuracy

Resolve duplicates, inconsistencies, and hidden data issues before they become a risk. Protect your business from costly penalties with clean, audit-ready data.

Fast Deployment, Zero Disruption

Deploy across any CBS or legacy system with minimal IT effort. A frictionless FSCS SCV reporting solution ready for rapid use.

Operational Resilience Guaranteed

Ensure uninterrupted FSCS SCV reporting with 99.99% uptime, secure dual-zone UK hosting, and strong governance controls.

Eliminate regulatory risk with a proven FSCS SCV Reporting Audit Solution

Empower your compliance, risk and audit teams with a platform that reduces remediation, strengthens PRA audit outcomes, and delivers consistent FSCS Regulatory Compliance across every SCV cycle.

We do not spare any effort in ensuring data security and compliance

Our SCV Alliance - FSCS SCV Audit Platform is built on flexible and economical architecture that ensures strong data protection and is fully compliant with strict industry regulations.

Complies with ISO & OWASP standards

SOAP API services

Secure data capture

Robust 256-bit Encryption

Behaviour-based security captcha

Parameter-level validation

Microsoft Enterprise Grade Security

Strong customer authentication

Stringent data retention policies

Periodic VAPT to the webserver

URL copy prevention

Session Management

Latest framework with MVC standards

IP restrictions for Admin Portal

Malware Protection

3D Secure authentication

SAS, EIT, EAR, NLC, Physical and Web App Level Firewall

Asymmetric AES with RSA encryption/Diffie-Hellman

JWS to eliminate complicated installation/upgrading procedures

GUID Implementation

Still not convinced? Hear what our clients say

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Head of Compliance, Bank of India U.K. Operations

London

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

Risk Governance Manager, Riyad Bank

London

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Head of Operations, IT & Facilities, ICICI Bank UK Plc

London

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

IT Manager, Bank Sepah International plc

London

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.

FSCS SCV Reporting FAQs – How our audit Solution supports you

What validation mechanisms does SCV Alliance use to ensure data accuracy?

SCV Alliance utilises multi-level validations with third-party data sources, including FCA, Royal Mail, Companies House, IBAN, OFAC, and more, as well as automated business rule checks and field-specific data integrity logic to identify and resolve inconsistencies before submission. Exception reports ensure visibility and traceability.

Can SCV Alliance identify and flag duplicate or inconsistent customer records?

Yes, SCV Alliance uses AI-powered fuzzy logic validation and intelligent deduplication techniques to identify and flag duplicate, incomplete, or inconsistent customer records. It applies over 175 audit checkpoints to validate customer and account information sourced from Core Banking Systems or staging areas. By analyzing data quality issues such as poor aggregation, inaccurate account segmentation, and mismatched relationships, SCV Alliance ensures clean, compliant datasets.

How does SCV Alliance highlight gaps in regulatory report readiness?

SCV Alliance validates data using 175+ audit checkpoints and classifies risks as High, Medium, or Low. It generates effectiveness and completeness reports that identify data gaps, highlight missing or inconsistent fields, and provide actionable recommendations to improve FSCS SCV output accuracy and readiness for regulatory submission.

How quickly can SCV Alliance be deployed in a cloud or on-premise environment?

SCV Alliance supports rapid deployment in both Azure Cloud and on-premise setups, with implementation timelines ranging from 2–4 weeks depending on data complexity and system readiness.

What file formats does SCV Alliance support for inputs and audit outputs?

The platform supports multiple input formats, including CSV, XML, XLSX and other FSCS-compatible schemas, and outputs audit-ready files and exception reports for seamless FSCS regulatory submission.

Can SCV Alliance be deployed standalone, or is it part of an integrated suite?

Yes, SCV Alliance can function independently as a dedicated audit platform for FSCS SCV reporting or be deployed as part of the enterprise SCV Suite alongside SCV Forza for end-to-end automation and compliance.

How does SCV Alliance support on-demand reporting and audit readiness within 24 hours?

Designed for fast execution, it delivers automated, on-demand SCV audits—using its pre‑built rule engine and real-time dashboards to produce regulator-ready validation outputs within tight timeframes.

What kind of dashboards and exception tracking does SCV Alliance offer?

It offers real-time dashboards showing validation status, exceptions, and data gaps, with drill-down capabilities, historical audit comparisons, and risk-level classification.

FSCS SCV Reporting insights, guides & case studies

CASE STUDY

Unlocking Data Accuracy & Security: Macro Global's Key to The UK Bank's FSCS SCV Reporting Success

CASE STUDY

Bridging the Data Gap: A Building Society's Journey to Efficient FSCS SCV Reporting

CASE STUDY

Excel to Excellence: Modernising FSCS Regulatory Reporting in Building Societies

WHITEPAPER

Revolutionising FSCS SCV Reporting: Ensuring Data Accuracy and Integrity by Resolving Technology Challenges

WHITEPAPER

Empower Credit Unions with a Data Management Edge: Mastering FSCS SCV Reporting with MG

WHITEPAPER

FSCS Regulatory Reporting on Cloud: Cloud Adoption of FIs

BUSINESS CASE

Benchmarking FSCS SCV Readiness through a Compliance Maturity Model

BUSINESS CASE

Macro Global's SCV Approach and Implementation

BUSINESS CASE