© 2026 Macro Global. All Rights Reserved.

FINASTRA EQUATION CONSULTING SERVICES

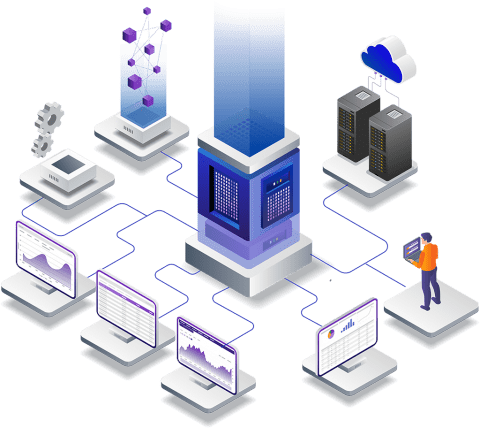

Unlock new possibilities and streamline processes with our powerful Straight Through Processing services

Seamless Integration and Superior Banking achieved with our Finastra Equation experts.

Achieve unmatched precision and speed in banking with our STP Services

Gain the matchless seamless transactions and enhanced efficiency with Finastra Equation's Straight-Through Processing

Efficiency Redefined

Automate end-to-end processes to significantly reduce processing times and operational costs, enabling your business to handle higher transaction volumes effortlessly.

Enhanced Accuracy

Minimise human errors through automated processing, ensuring precise and reliable transactions that build customer trust and satisfaction.

Continuous Improvement

Enjoy ongoing support and updates to keep your Straight through Processing services aligned with industry advancements, ensuring continuous enhancement and future-readiness.

Enhance accuracy and efficiency with Finastra Equation's Straight-Through Processing Solutions

Finastra Equation Core Banking Application experts from ZetaRP, prioritises compliance and security with robust measures and regulatory adherence, safeguarding sensitive data through advanced encryption and authentication. Our real-time processing capabilities enable rapid access to critical financial data, empowering informed decision-making and responsive customer service.

Our seamless Straight through Processing implementation and integration services, automate transactions to enhance efficiency and reduce manual tasks. With a keen focus on customisation and scalability, our solutions adapt to your business needs, optimising workflows and increasing operational agility.

Comprehensive training and support empower your staff to effectively utilise our solutions, ensuring ongoing operational improvement and reliability.

Achieving seamless transactions through targeted Straight-Through Processing strategies

Enhancing Success with Strategic STP Solutions and Systematic Approach

01. Idea Generation

We engage stakeholders in dynamic, collaborative sessions to cultivate and prioritise pioneering ideas that align with our strategic Straight through Processing goals and evolving industry trends.

02. Prototyping and Iterative Development

We employ iterative prototyping techniques to swiftly visualize concepts, gather actionable feedback from Straight through Processing stakeholders, and iteratively refine solutions based on rigorous user testing, ensuring continuous enhancement and alignment with stakeholder expectations.

03. Agile Methodologies

We adopt agile methodologies to meticulously plan and execute Finastra Equation’s Straight through Processing projects in iterative sprints, optimising task management and maintaining strict adherence to project timelines, thus accelerating time-to-market and enhancing project outcomes.

04. User-Centric Design

We conduct comprehensive Straight through Processing user research and usability assessments in Finastra Equation to inform the development of intuitive interfaces and functionalities that prioritize user experience, resulting in heightened user satisfaction and operational efficiency.

05. Change Management and Adoption Strategy

We develop robust STP change leadership strategies and adoption frameworks, encompassing tailored training programmes and proactive communication strategies, to facilitate seamless transitions and maximise organisational buy-in and utilisation of STP solutions.

Enhancing banking efficiency with bespoke Straight-Through Processing Solutions

Optimize service delivery through faster transaction processing and improved responsiveness.

Enhanced Efficiency

Automate transaction processing to streamline operations and reduce manual tasks.

Improved Accuracy

Minimise errors and enhance reliability in financial transactions.

Scalability

Adapt solutions to accommodate growing transaction volumes and business needs.

Compliance

Ensure regulatory adherence and data security through robust measures.

Real-Time Insights

Access critical financial data promptly for informed decision-making.

Cost Efficiency

Reduce operational costs through automation and optimised workflows.

Unlocking innovation and efficiency to propel your financial services forward

Driving banking success through diverse STP process methodologies and acumen bringing pivotal advantages

Expertise and Experience

Bringing years of industry expertise and experience in delivering solutions tailored to the banking sector's unique needs in Finastra Equation.

Innovative Solutions

Offering cutting-edge, innovative solutions that leverage the latest technologies to enhance operational efficiency and customer satisfaction.

Scalability and Flexibility

Providing scalable solutions that can grow with your business, adapting to changing requirements and market conditions.

Customer-Centric Approach

Focusing on understanding and meeting the specific needs of clients, ensuring solutions are aligned with business objectives and customer expectations.

Comprehensive Support

Offering comprehensive support throughout the implementation and beyond, ensuring smooth integration and ongoing success of solutions.

Value for Investment

Delivering measurable value, optimising processes, reducing costs, and driving revenue growth through tailored solutions.

Related Resources

Trusted by UK-regulated Financial Institutions

Still Not Convinced? Hear What Our Clients Say

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Previous

Next