© 2026 Macro Global. All Rights Reserved.

FSCS SCV REGULATORY REPORTING SOLUTION

Automate FSCS SCV Output File Generation & Reconciliation from any CBS or Data Repository

SCV Forza, an end-to-end FSCS SCV reporting automation platform that generates FSCS-compliant SCV files with full evidence packs, lineage, and traceability.

- Makes every FSCS SCV reporting predictable and stress-free.

- Improves SCV data quality with AI-driven cleansing.

- Ensures every SCV submission is fully FSCS-compliant.

- Stays ready with real-time SCV visibility and alerts.

- Reduces audit pressure with complete SCV traceability.

Play Video

15+

Banks trust SCV Alliance

15+

Years of product maturity

7+

CBS integrations

10+

External data sources

Trusted by UK-regulated Financial Institutions

What is SCV Forza?

Overcome the Most Complex FSCS SCV Reporting Challenges with the Proven FSCS SCV Automation Platform, SCV Forza

Eliminate data issues, reduce manual effort, and deliver accurate, compliant FSCS SCV reporting, every cycle.

Turns messy data into clean, FSCS-ready SCV records

Centralises depositor, account, and balance data from multiple sources, then cleanses and enriches it to produce complete, accurate, FSCS-compliant SCV files.

Automates reconciliations and FSCS/PRA rule checks

Automatically reconciles accounts and

applies FSCS/PRA rules to resolve data

inconsistencies, generates effectiveness,

exception, and additional SCV reports.

Delivers traceable SCV data and compliance assurance

Provides real-time visibility into SCV data, backed by evidence packs and traceable lineage, so every FSCS SCV cycle is compliant, predictable, and audit-ready.

FSCS Lifts Deposit Protection to £120K. Is Your SCV System Ready for the Higher Threshold?

Ensure your institution meets stricter FSCS and PRA expectations with an expert-led SCV risk and compliance review.

How SCV Forza helps?

The FSCS SCV Reporting Automation Benefits that Matter Most to Your Teams

SCV Forza delivers targeted outcomes for Compliance, Risk, Technology, and Security teams, reducing manual effort, improving accuracy, and strengthening regulatory confidence.

For Compliance Teams

- Reconciles multi-source account balances and customer data to generate FSCS-compliant SCV output files, reducing manual errors.

- Applies FSCS SCV rules and validations consistently across all depositor records, eliminating inconsistencies.

- Automatically generates submission-ready Evidence Packs for FSCS and auditors, reducing last minute pressure.

- Streamlines exception identification and resolution through automated workflows, accelerating SCV submission readiness.

For Risk & Governance Teams

- Provides real-time SCV readiness visibility across all datasets, highlighting data quality, reconciliation health, and exceptions.

- Maintains end-to-end SCV data lineage from source systems to FSCS outputs for complete transparency.

- Ensures full audit traceability with detailed logging of validations, corrections, and reconciliations.

- Detects risks early through automated alerts that flag quality issues, eligibility gaps, mismatches, and anomalies.

For Technology Teams

- Seamlessly integrates with CBS, ledger, and legacy systems to ingest SCV data without manual intervention.

- Automates SCV ETL, validation, reconciliation, and output generation to improve reliability and reduce errors.

- Provides end-to-end technical traceability across SCV data flows and rule execution for faster root-cause analysis.

- Maintains versioned SCV data lineage to support safe change management, impact analysis, and historical re-runs.

For Security Teams

- Protects sensitive SCV depositor data using enterprise-grade encryption, secure access controls, and hardened workflows.

- Enforces strict data governance through role-based access, segregation of duties, and continuous monitoring across SCV processing and output files.

- Captures detailed audit logs of all user actions, system activity, and SCV data changes.

- Supports continuous compliance with ISO, OWASP, and institutional security standards through built-in controls and security protocols.

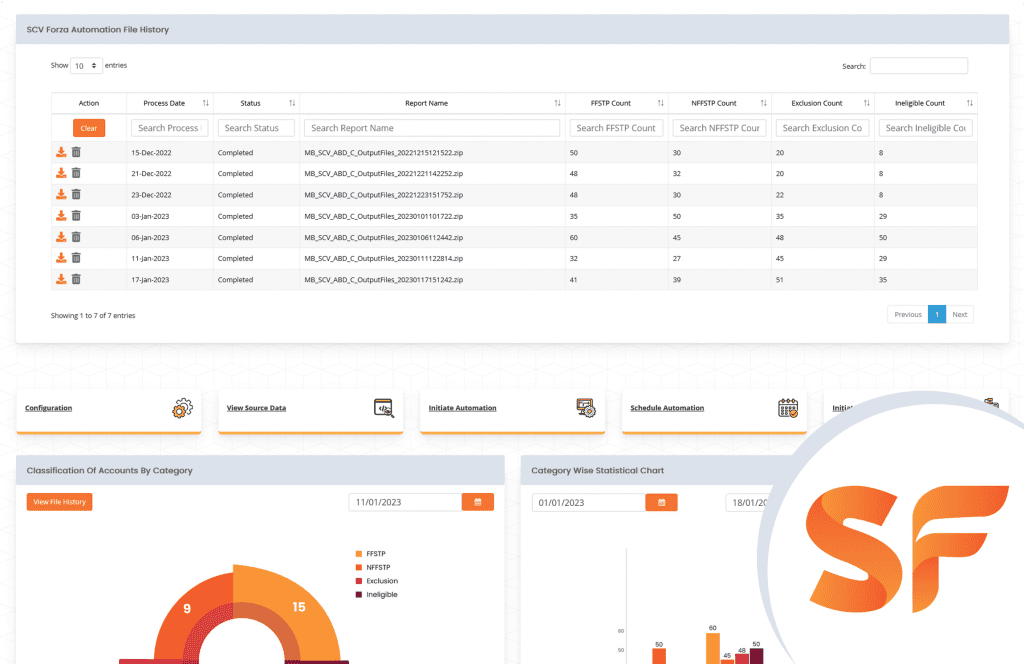

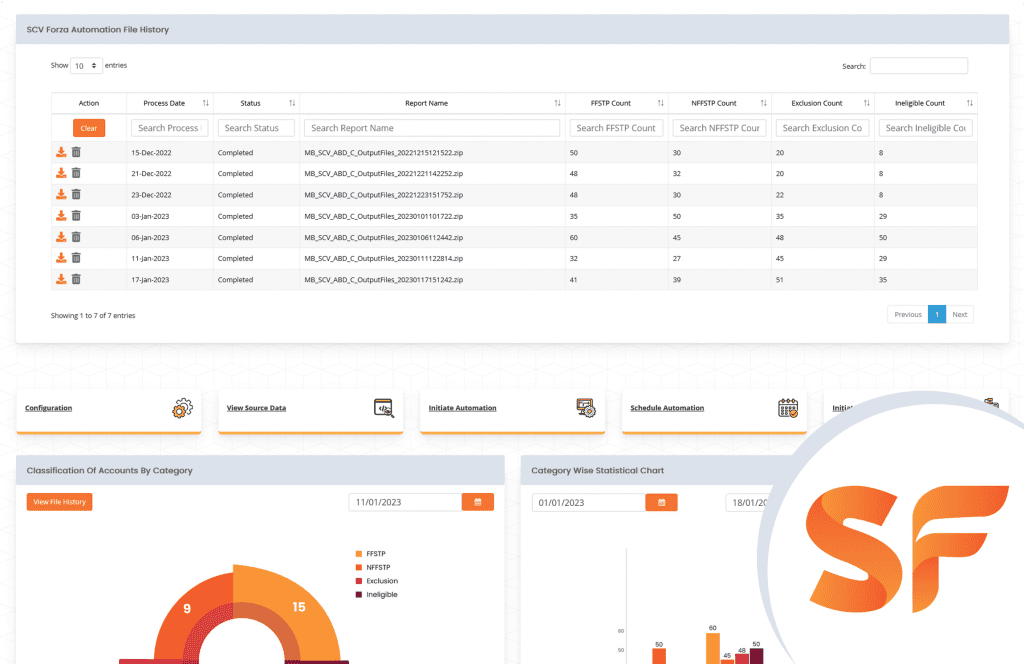

Platform Capabilities

Inside the SCV Forza Platform: Four Integrated Capabilities for End-to-End FSCS SCV Reporting Automation

From data ingestion to SCV file generation, SCV Forza delivers the full suite of capabilities required for automated, compliant FSCS SCV reporting.

SCV Data Ingestion &

Generation

Standardises data from multiple sources to produce FSCS-compliant, and traceable SCV records.

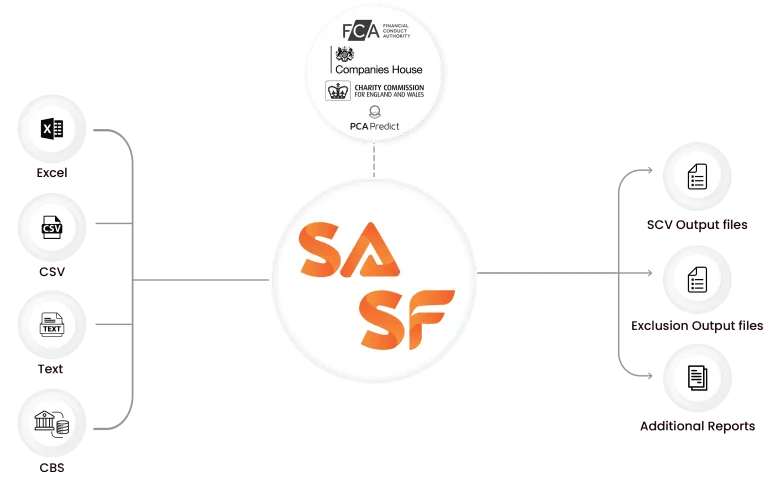

- Multi-format ingestion (CSV, TXT, Excel) from CBS, ledger, and legacy sources

- Push/pull extraction powered by a robust ETL orchestration engine (SSIS-class workflows)

- Configurable mapping for complex depositor and account structures

- Centralised staging for structured pre-processing and normalisation

- Enrichment of data with FSCS-required fields and classifications

- Traceability of source inputs to prepared SCV datasets

SCV Data Processing & Reconciliation

Automate reconciliations, detect anomalies, and process SCV data reliably with AI-driven logic.

- AI-assisted eligibility checks and depositor consolidation

- Real-time validation across FSCS-mandated depositor, account, and balance data fields

- Automated cleansing of inconsistencies, duplicates, and missing attributes

- Automated reconciliation of balances, linked accounts, joint accounts, and thresholds

- Exception and anomaly detection using AI-based pattern detection algorithms

- High-volume processing engine optimised for large institutions

- Continuous operational traceability and early issue flagging

FSCS Compliance Logic & Evidences

Apply FSCS rules automatically and produce audit-ready outputs backed by evidence and traceability.

- Continuously updated FSCS rule engine maintained by regulatory experts

- Configurable validation and reporting logic aligned to institution policies

- Mandatory-field completeness checks

- End‑to‑end traceability and detailed evidence packs

- Governance dashboards for internal review and sign-off

- Auto-classification of depositor categories and eligibility outcomes

SCV Workflow Automation & Orchestration

Streamline SCV cycles with repeatable, low-touch workflows and real-time visibility.

- Scheduled runs and recurring SCV refresh workflows

- Parallel execution for accelerated cycle completion

- Intelligent compute and resource optimisation for heavy datasets

- Automated re-run and exception handling sequences

- Real-time operations dashboard for SCV cycle status, exceptions, and readiness

- Ensures smooth fulfilment even during 24-hour FSCS deadlines

Stop Manual SCV Reporting. Integrate with your Existing Systems and Generate FSCS-ready SCV Output Files & Additonal Reports with Automated Workflows

How SCV Forza works?

FSCS SCV Automation Workflow: From Data Extraction to SCV & Exclusion File Generation

SCV Forza streamlines SCV data preparation, validation, reconciliation, and FSCS-aligned reporting through a fully automated four-step process.

01

Automated Data Extraction

Securely extracts depositor, account, product, and balance data from CBS, ledger, and legacy systems, capturing all FSCS-required fields.

02

Cleansing, Validation & Enrichment

AI-assisted logic identifies and corrects data inaccuracies and duplicates, enriches records with FSCS-required attributes, and applies PRA/FSCS schema validations for complete SCV readiness.

03

Smart SCV Reconciliation & Exception Resolution

Automatically reconciles depositor-account relationships, balances, thresholds, and eligibility markers, flagging exceptions early for faster remediation and more accurate outputs.

04

FSCS-Compliant SCV/Exclusion File Generation

Generates FSCS-compliant SCV and Exclusion files aligned to PRA/FSCS requirements, complete with audit-ready data lineage and traceability.

Why Choose SCV Forza?

Why Leading UK Institutions Choose SCV Forza for FSCS SCV Reporting Automation

A trusted FSCS SCV automation platform that delivers accuracy, speed, compliance, and complete operational confidence across every reporting cycle.

AI-Assisted FSCS Accuracy with Reduced Manual Risk

SCV Forza applies advanced validation, eligibility logic and depositor-account reconciliation across every dataset, ensuring FSCS-aligned SCV and Exclusion files with near-zero discrepancies.

Always Up-to-Date with FSCS & PRA Changes

SCV Forza automatically updates FSCS rule logic, PRA schema formats and validation requirements, protecting your institution from regulatory drift.

End-to-End Automation that Cuts SCV Processing Time by 90%

From ingestion to reconciliation to final SCV file generation, SCV Forza automates everything, eliminates repetitive manual work and spreadsheet dependency.

Consistent, High-Speed Performance Under Tight FSCS Deadlines

SCV Forza is built to handle peak loads, large datasets, multi-account relationships, and complex balance structures with stable, predictable throughput.

Full Traceability with Audit-Ready Data Lineage

Every transformation, validation, correction and reconciliation is logged with complete lineage from ingestion to final SCV/Exclusion file.

Backed by Deep FSCS Regulatory Expertise

Built by teams with decades of FSCS SCV, PRA reporting, and UK regulatory experience, ensuring every institution receives trusted guidance and smooth implementation.

How secure is SCV Forza?

Enterprise-grade Security and Compliance for FSCS SCV Reporting Automation

With flexible architecture, session-based controls, and multi-factor authentication, SCV Forza ensures end-to-end data protection and supports FSCS compliance.

Data Security & Encryption

Controls

- Robust 256-bit encryption

- Asymmetric AES with RSA / Diffie–Hellman key exchange

- Secure data capture

- SAS, EIT, EAR encryption standards

- JWS for secure packaging & update management

- GUID implementation for unique, tamper-proof identification

- SOAP API services with secure encoding

- Microsoft Enterprise-grade Security

Application Security & Access Protection

- Complies with ISO & OWASP security standards

- Parameter-level validation to prevent injection attacks

- Behaviour-based security CAPTCHA

- URL copy prevention

- 3D Secure authentication

- Latest MVC framework security standards

- Strong customer authentication

- Session management to prevent hijacking

- IP restrictions for the Admin Portal

Network & Infrastructure

Security

- SAS, EIT, EAR, NLC and multi-layer firewall protection

- Physical and Web Application firewalls

- Malware protection

- Periodic VAPT (Vulnerability Assessment & Penetration Testing)

- Secure authentication and access control

- Resilient hosting environment (implied by enterprise-grade setup)

Governance, Compliance & Data Handling

- Stringent data retention policies

- Compliance with ISO security frameworks

- Compliance with OWASP secure coding practices

- Admin-level access restrictions

- Full auditability via SCV Alliance governance

Still Not Convinced? Hear What Our Clients Say

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Previous

Next

FSCS SCV Reporting FAQs – How Our Automation Solution Supports You

What makes SCV Forza different from other FSCS SCV reporting automation tools?

SCV Forza is an AI-powered FSCS SCV reporting automation tool that orchestrates end-to-end SCV automation, from extraction and enrichment to validation and supports RegData submission. It includes automated rule updates and FSCS-aligned templates to help teams deliver faster, more accurate, compliant submissions.

How does SCV Forza ensure data enrichment and reconciliation during report generation?

SCV Forza uses AI-based fuzzy logic and rule-driven validations to enrich data, eliminate duplication, and reconcile customer records. It processes only cleansed data from gap studies and staging areas, ensuring accuracy and FSCS compliance. The platform manages account linkage, segmentation, and aggregation with precision, producing secure, encrypted reports aligned with FSCS standards—ready for submission only after thorough validations.

How scalable is SCV Forza, and how many records can it process at once?

SCV Forza is built on Microsoft SSIS and is highly scalable, capable of handling over 50 million records per batch with high throughput and minimal latency. Its performance-optimised ETL engine makes it ideal for large banks and financial institutions managing complex, high-volume datasets.

How quickly can SCV Forza be deployed in a cloud or on-premise environment?

SCV Forza supports rapid deployment in both Azure Cloud and on-premise setups, with implementation timelines ranging from 2–4 weeks depending on data complexity and system readiness.

Does the solution support integration with legacy Core Banking Systems (CBS)?

Yes, SCV Forza is designed with flexible architecture and supports integration with all major CBS through ETL, API, and flat file ingestion.

Does SCV Forza include dashboards for performance monitoring and exception reporting?

Yes, SCV Forza features intuitive dashboards that provide real-time visibility into SCV reporting status, data readiness, and reconciliation gaps. It also includes built-in performance analytics and drill-down exception reports to identify data issues, track trends, and deliver actionable insights for compliance teams.

Can the SCV reporting tool automatically align SCV reports to the latest FSCS template formats?

Yes, SCV Forza automatically maps data fields and formats outputs based on the most recent FSCS template specifications.

FSCS SCV Reporting Resources (Guides, Frameworks, Case Studies)

BUSINESS CASE

BUSINESS CASE