© 2026 Macro Global. All Rights Reserved.

FSCS SCV REGULATORY REPORTING SOLUTION

FSCS Single Customer View (SCV) Reporting Software for Audit-Ready Accuracy & Compliance

Audit and validate FSCS SCV & Exclusions files with SCV Alliance, an intelligent SCV audit platform:

- Delivers High-Accuracy SCV Reporting with Zero Manual Burden

- Strengthens Data Quality, Governance & Traceability

- Ensures Consistent, PRA-Aligned “Green Status” Compliance

- Maintains Secure, Always-On FSCS SCV Readiness

Play Video

15+

Banks trust SCV Alliance

15+

Years of product maturity

175+

Audit checkpoints

2 Million

Validations each month

14,000+

Client audits from year 2010

Trusted by UK-regulated Financial Institutions

Who SCV Alliance is for?

Meet SCV Alliance, FSCS SCV Reporting Audit & Validation Engine Built for 24‑hour Readiness

Built for UK Banks, Building Societies, Credit Unions and other financial institutions, delivering accurate, compliant SCV reporting with reduced regulatory risk.

For Banks

Audit and validate high-volume SCV output files against FSCS/PRA rules with evidence packs and data lineage supporting audit confidence and 24-hour readiness.

For Building Societies

Validate FSCS Single Customer View reporting with configurable business rules and strong governance controls avoiding costly remediation and audit escalations.

For Credit Unions

Automate SCV validation and exception reporting, generating evidence packs for audit-ready FSCS SCV reporting ideal for small teams and legacy systems.

Is Your SCV Ready for 24‑hour FSCS Reporting Requirements and the £120K Limit?

Get an expert SCV readiness review to identify completeness, effectiveness, reconciliation and exception gaps before FSCS/PRA scrutiny.

How SCV Alliance helps?

How SCV Alliance Helps Every Team Audit, Validate & Evidence FSCS SCV Reporting

A unified FSCS Single Customer View reporting platform designed for Compliance, Risk, Technology, and Security teams, ensuring accuracy, governance, and 24-hour SCV readiness.

For Compliance Teams

Audit & Assurance Engine

- Reduce regulatory and audit risk with 175+ FSCS & PRA-aligned validation rules that surface critical data issues early and generate audit-ready exception reports, evidence packs, and audit outputs to support each SCV cycle.

- Strengthen audit defensibility through external data screening and end-to-end traceability, providing Risk, Compliance, and Internal Audit teams clear evidence of SCV quality and change history.

- Accelerate compliance readiness with regulator-ready reporting (reconciliation, completeness, effectiveness, and exceptions) enhanced with predictive analytics for stronger governance decisions and continuous improvement.

For Risk & Governance Teams

Control & Governance Suite

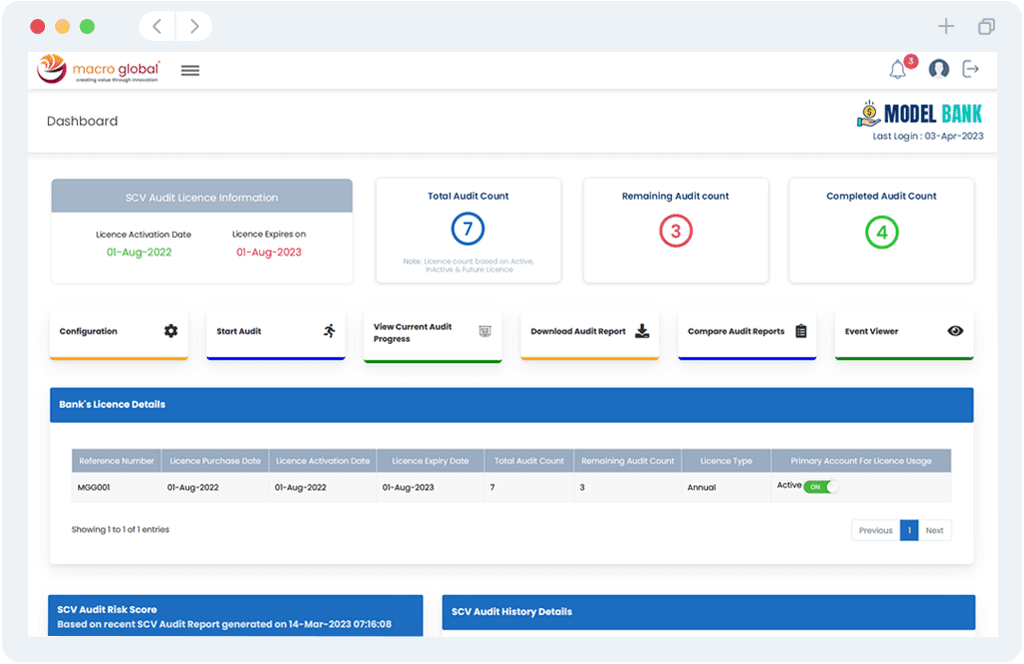

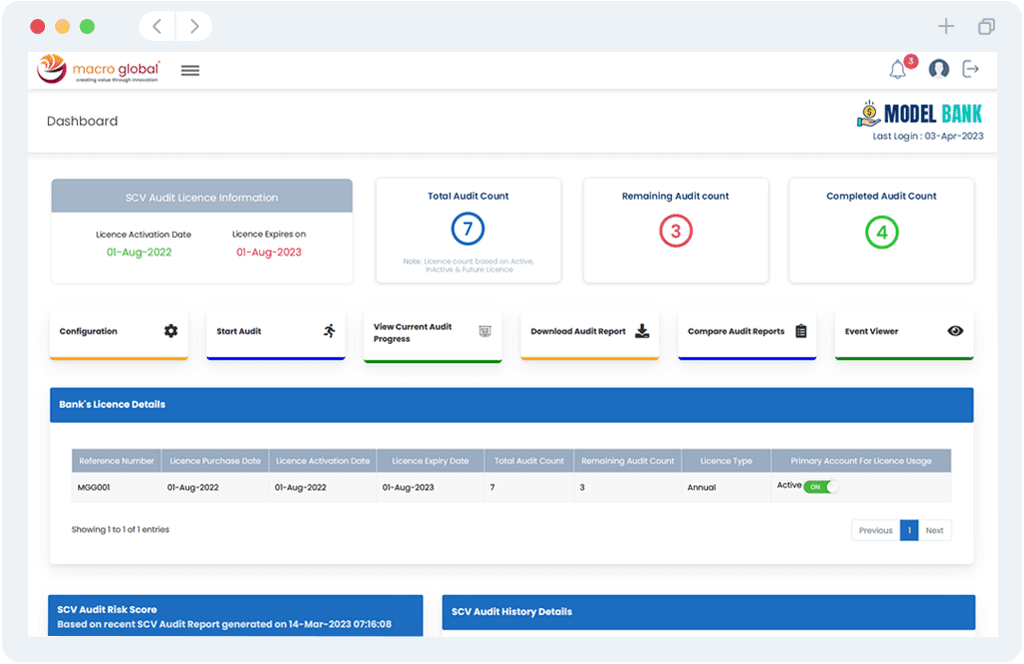

- Gain end-to-end Single Customer View visibility through a unified dashboard that surfaces exceptions, rule performance, audit status, data quality trends, and configuration changes so governance teams can monitor readiness across every SCV cycle.

- Maintain consistent, compliant FSCS SCV reporting operations with configurable rules, validation thresholds, and EOD processing logic aligned to your CBS and internal governance frameworks.

- Strengthen oversight and accountability with enterprise role-based access, audit logs, and segregation-of-duties controls, supporting FCA/PRA governance expectations and internal audit standards.

For Technology Teams

Integrations & Data Connectivity Layer

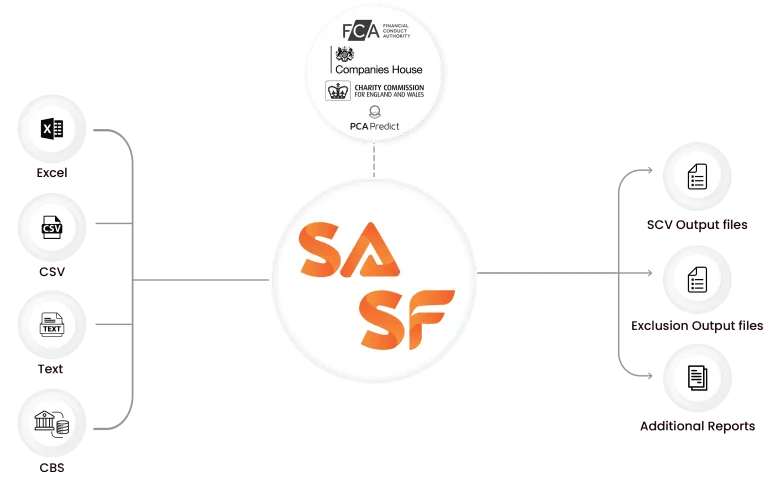

- Integrate SCV Alliance into your environment using standard ingestion patterns (ETL, API, or file-based transfers) from CBS, ledgers, and data repositories to validate SCV outputs and supporting datasets.

- Reduce operational bottlenecks with automated FSCS SCV validation checks, pipeline monitoring, and alerting, so exceptions and failures are detected early with minimal manual effort.

- Strengthen governance and SCV audit confidence with enterprise integrations (CRM, AML/KYC, data lakes, SSIS/Power BI) and transparent, auditable flows that preserve full Single Customer View traceability.

For Security Teams

Security & Data Protection Layer

- Protect depositor data with encryption in transit and at rest, plus secure handling across ingestion, validation, SCV file workflows, and reporting, ensuring confidentiality, integrity and regulated institution requirements.

- Strengthen governance with enterprise access controls (RBAC), secure authentication, and full audit logging, providing traceability of validations, configurations, and user actions across the Single Customer View reporting audit lifecycle.

- Reduce cyber and operational risk with resilient, VAPT-tested architecture, continuous monitoring, and secure session controls aligned with PRA/FCA expectations for data protection and operational resilience.

Improve FSCS SCV Reporting Accuracy Before Audits and Regulatory Reviews

SCV Alliance provides audit-grade validation, governance and evidence so your SCV submissions remain accurate, defensible and repeatable.

Core Capabilities of SCV Alliance

The Complete FSCS SCV Reporting Audit Software Built for Accuracy, Governance & Compliance

SCV Alliance unifies audit, reporting, governance, and integration capabilities to deliver reliable, compliant Single Customer View outputs across all FSCS SCV cycles.

Audit & Assurance Engine

Strengthen FSCS SCV accuracy, audit defensibility & regulatory compliance.

- 175+ AI-powered audit checkpoints

- AI-based predictive analysis for SCV trends

- Third-party data screening (FCA, PAF, Companies House, OFAC)

- Data-rich SCV reporting & reconciliation checks

- Compliance exception handling workflows

- Fuzzy entity matching & depositor identity resolution

- Error root-cause insights to speed remediation

- Data quality score tracking

- Multi-format import of FSCS SCV reports

Control & Governance Suite

Gain complete oversight, SCV lineage visibility & governance-grade controls.

- Historic audit comparison for SCV data lineage

- Interactive FSCS SCV dashboard for full visibility

- Centralised audit & activity logs

- Controlled user management for teams

- Secure role-based permissions

- Customisable compliance & business rules

- Simplified bank-level settings for quick onboarding

Integrations & Data Connectivity Layer

Ensure seamless CBS integration, automation & scalable SCV infrastructure.

- Seamless CBS & external systems integration

- API gateway connectivity for enterprise interoperability

- Multi-format SCV import/export capabilities

- Agentic AI chatbots to automate operational tasks

- High-performance integration layer supporting end-to-end SCV automation

How SCV Alliance Works?

Achieve Audit-Ready FSCS Single Customer View Reporting in 5 Steps

01

Ingest SCV Output Files

Import your SCV output files and supporting datasets via file upload, ETL, or API—ready for FSCS Single Customer View reporting audit.

02

Validate Against FSCS/PRA Requirements

Run 175+ FSCS & PRA-aligned validations including business rules, exclusions and FSCS eligibility checks to identify gaps, inconsistencies, and misclassifications.

03

Screen & Enrich for Assurance

Strengthen SCV confidence with trusted third-party screening and enrichment, improving data defensibility and reducing audit risk.

04

Generate Evidence Packs & Audit Reporting

Produce regulator-ready outputs evidence packs, exception reporting, and completeness/effectiveness insights, to support governance and remediation.

05

Monitor Readiness with Full Traceability

Track 24-hour SCV readiness visibility with dashboards, audit logs, and configuration history, keeping every FSCS SCV reporting cycle auditable and repeatable.

Why Choose SCV Alliance?

Purpose-built SCV Reporting Software Engineered for FSCS Audit Resilience

SCV Alliance is an evidence-backed FSCS SCV audit platform that delivers the expertise, resilience, and precision needed for compliant, defensible submissions.

Always current with FSCS & PRA rule updates

Automatically stays current with evolving FSCS and PRA rules, so your institution never falls behind regulatory change.

Expert FSCS Assurance & SCV Consulting

Access FSCS and SCV specialists guide your teams through audits, remediation, and best practices to strengthen compliance confidence.

Purpose-built for PRA & FSCS Expectations

Designed specifically for FSCS SCV regulatory regimes, not repurposed from generic data tools ensuring perfect compliance alignment.

Scalable for Institutions of Any Size

Scales seamlessly for small credit unions to large banks handling high-volume depositor files, complex data models, and multi-entity portfolios.

Operational Resilience Guaranteed

Built in the UK, ensures uninterrupted FSCS SCV reporting with 99.99% uptime, secure dual-zone UK hosting, and strong governance controls.

Fast Deployment, Zero Disruption

Deploy across any CBS or legacy system with minimal IT effort. A frictionless FSCS SCV reporting solution ready for rapid use.

Eliminate Regulatory Risk with Proven FSCS SCV Audit & Validation Software

Empower your compliance, risk and audit teams with a platform that reduces remediation, strengthens PRA audit outcomes, and delivers consistent FSCS Regulatory Compliance across every SCV cycle.

How secure is SCV Alliance?

Compliance-first Single Customer View Reporting Software, Built for Data Integrity and Enterprise-Grade Security

Our SCV Alliance - FSCS SCV Audit Platform is built on flexible and economical architecture that ensures strong data protection and is fully compliant with strict industry regulations.

Data Security & Encryption

Controls

- Robust 256-bit encryption

- Asymmetric AES with RSA / Diffie–Hellman key exchange

- Secure data capture

- SAS, EIT, EAR encryption standards

- JWS for secure packaging & update management

- GUID implementation for unique, tamper-proof identification

- SOAP API services with secure encoding

- Microsoft Enterprise-grade Security

Application Security & Access Protection

- Complies with ISO & OWASP security standards

- Parameter-level validation to prevent injection attacks

- Behaviour-based security CAPTCHA

- URL copy prevention

- 3D Secure authentication

- Latest MVC framework security standards

- Strong customer authentication

- Session management to prevent hijacking

- IP restrictions for the Admin Portal

Network & Infrastructure

Security

- SAS, EIT, EAR, NLC and multi-layer firewall protection

- Physical and Web Application firewalls

- Malware protection

- Periodic VAPT (Vulnerability Assessment & Penetration Testing)

- Secure authentication and access control

- Resilient hosting environment (implied by enterprise-grade setup)

Governance, Compliance & Data Handling

- Stringent data retention policies

- Compliance with ISO security frameworks

- Compliance with OWASP secure coding practices

- Admin-level access restrictions

- Full auditability via SCV Alliance governance

Still Not Convinced? Hear What Our Clients Say

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Previous

Next

FSCS SCV Reporting FAQs – How Our Audit Solution Supports You

What validation mechanisms does SCV Alliance use to ensure data accuracy?

SCV Alliance, a purpose-built FSCS SCV reporting solution, leverages multi-level validations to ensure data accuracy across customer and account records. The platform integrates with trusted third-party data sources such as FCA, Royal Mail, Companies House, IBAN, and OFAC. Through its automated rule engine, this FSCS single customer view reporting software applies field-specific data integrity logic and business rule checks to detect inconsistencies prior to submission. Exception reports provide complete visibility and traceability for FSCS SCV reporting.

Can SCV Alliance identify and flag duplicate or inconsistent customer records?

Yes. SCV Alliance employs AI-powered fuzzy logic and intelligent deduplication features to identify duplicate, incomplete, or inconsistent records within your FSCS single customer view reporting dataset. It executes over 175 audit checkpoints—making it one of the most rigorous FSCS SCV reporting software platforms available. Designed to validate data from Core Banking Systems, it addresses challenges like poor aggregation, inaccurate segmentation, and mismatched customer-account relationships—ensuring clean and compliant FSCS submissions.

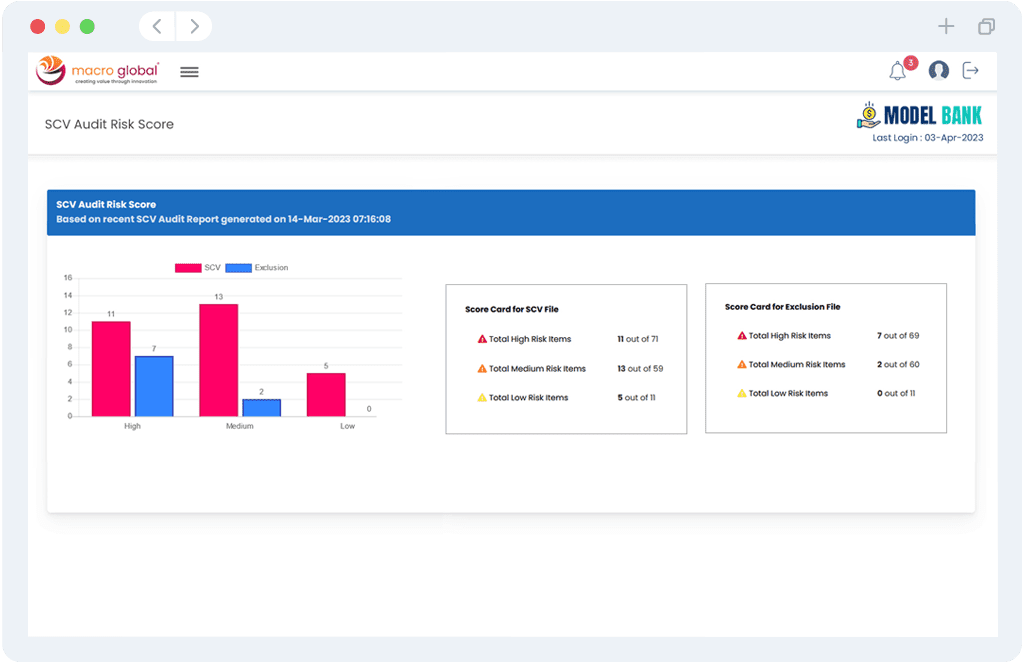

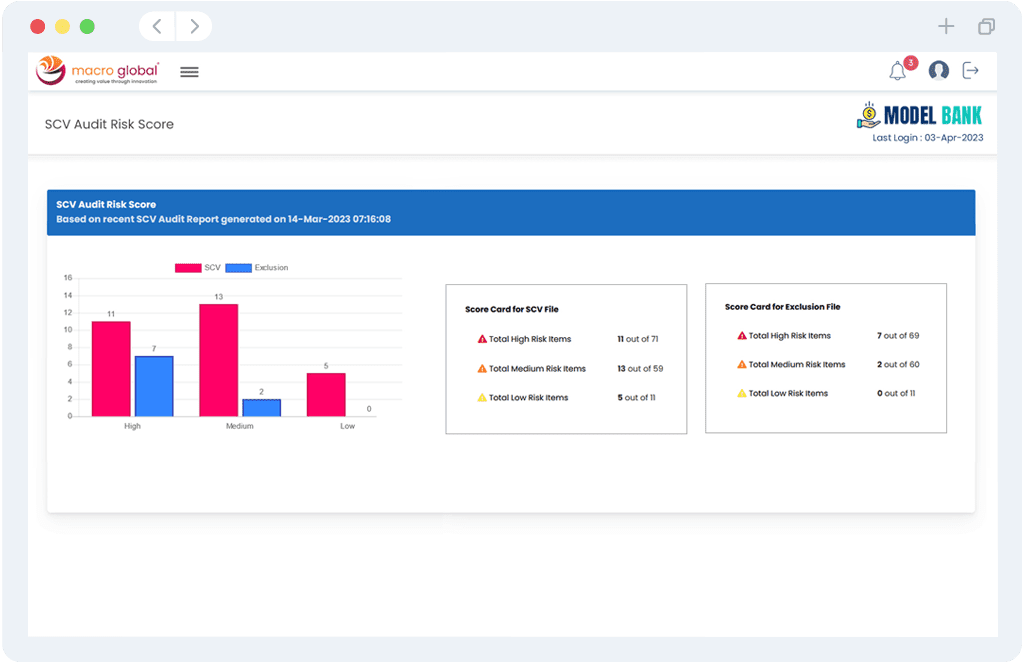

How does SCV Alliance highlight gaps in regulatory report readiness?

As a leading FSCS SCV reporting software, SCV Alliance uses a 175+ point audit framework to validate reporting data. It flags readiness gaps in FSCS single customer view reporting by categorizing risks (High, Medium, Low), generating completeness/effectiveness reports, and identifying field-level issues. These insights help institutions prepare fully accurate and regulator-ready SCV outputs in line with FSCS reporting solution standards.

How quickly can SCV Alliance be deployed in a cloud or on-premise environment?

SCV Alliance is a flexible FSCS SCV reporting solution available for rapid deployment in both Azure Cloud and on-premise environments. Depending on data complexity and infrastructure, the platform can be live in as little as 2–4 weeks—accelerating compliance with FSCS single customer view reporting requirements.

What file formats does SCV Alliance support for inputs and audit outputs?

This FSCS SCV reporting software supports a variety of formats including CSV, XML, and XLSX. It accepts raw and pre-aggregated data inputs, processes them against its rule engine, and outputs audit-ready files and exception reports fully aligned with FSCS compliance standards for single customer view reporting.

Can SCV Alliance be deployed standalone, or is it part of an integrated suite?

Yes. SCV Alliance can operate as a standalone FSCS SCV reporting platform or as part of Macro Global’s enterprise-grade SCV Suite. When integrated with SCV Forza, it forms a comprehensive FSCS single customer view reporting solution—enabling end-to-end automation, validation, and regulatory compliance for financial institutions.

How does SCV Alliance support on-demand reporting and audit readiness within 24 hours?

Built for speed and precision, SCV Alliance delivers on-demand FSCS SCV audits using pre-configured rules and real-time dashboards. This enables institutions to generate regulator-ready validation outputs in under 24 hours—supporting urgent FSCS requests and proactive single customer view reporting.

What kind of dashboards and exception tracking does SCV Alliance offer?

SCV Alliance includes rich dashboards and audit-trail features, allowing teams to monitor FSCS SCV reporting status in real-time. The platform displays validation coverage, exception types, historical audit logs, and data risk classifications—offering end-to-end visibility into your FSCS single customer view reporting process.

FSCS SCV Reporting Resources (Guides, Frameworks, Case Studies)

BUSINESS CASE

BUSINESS CASE