© 2026 Macro Global. All Rights Reserved.

FSCS SCV REGULATORY REPORTING SOLUTION

Robust FSCS SCV Reporting Solution with Audit & Automation for Confident Submissions

Choose the module you need — or combine both.

- SCV Forza automates SCV file generation and reconciliation, while SCV Alliance audits and validates SCV outputs against FSCS/PRA expectations to ensure every submission is compliant, traceable, and audit-ready.

Play Video

15+

Banks trust SCV Alliance

15+

Years of product maturity

7+

CBS intergration

10+

External data sources

Trusted by UK-regulated Financial Institutions

Which FSCS SCV Reporting Solution Do You Need?

Whether you are generating SCV files today or starting from fragmented CBS and data systems, choose the module that fits your current maturity.

Already producing SCV files? Make every submission audit-defensible.

SCV Alliance - FSCS SCV Audit Platform

SCV Alliance audits your SCV output and exclusions against FSCS/PRA expectations, highlighting issues early and generating evidence packs that make every submission traceable and audit-ready.

Need a reliable way to generate SCV files? Automate messy data into SCV outputs.

SCV Forza - FSCS SCV Automation Platform

SCV Forza automates SCV file generation and reconciliation from fragmented CBS and data systems — producing FSCS-compliant outputs with built-in controls, lineage, and full traceability.

Want end-to-end assurance? Automate + independently Audit with evidence.

All-in-One FSCS SCV Enterprise Solution Suite

Combine SCV Forza + SCV Alliance to generate SCV files automatically and independently audit the outputs — ensuring accuracy, completeness, compliance, and a defensible audit trail for every submission.

Assess Your FSCS SCV Maturity. Define Your Readiness Path

Evaluate your current SCV operating model using a compliance maturity framework and define a clear, defensible direction for achieving FSCS-ready reporting.

Solutions

A Complete Out-of-the-box FSCS SCV Reporting Solution with Automation and Audit-Ready Capabilities, Powering Next-level FSCS SCV Regulatory Reporting.

Our FSCS SCV Enterprise Solution Suite enhances operational efficiency by reducing workload by 30%, and ensuring data accuracy.

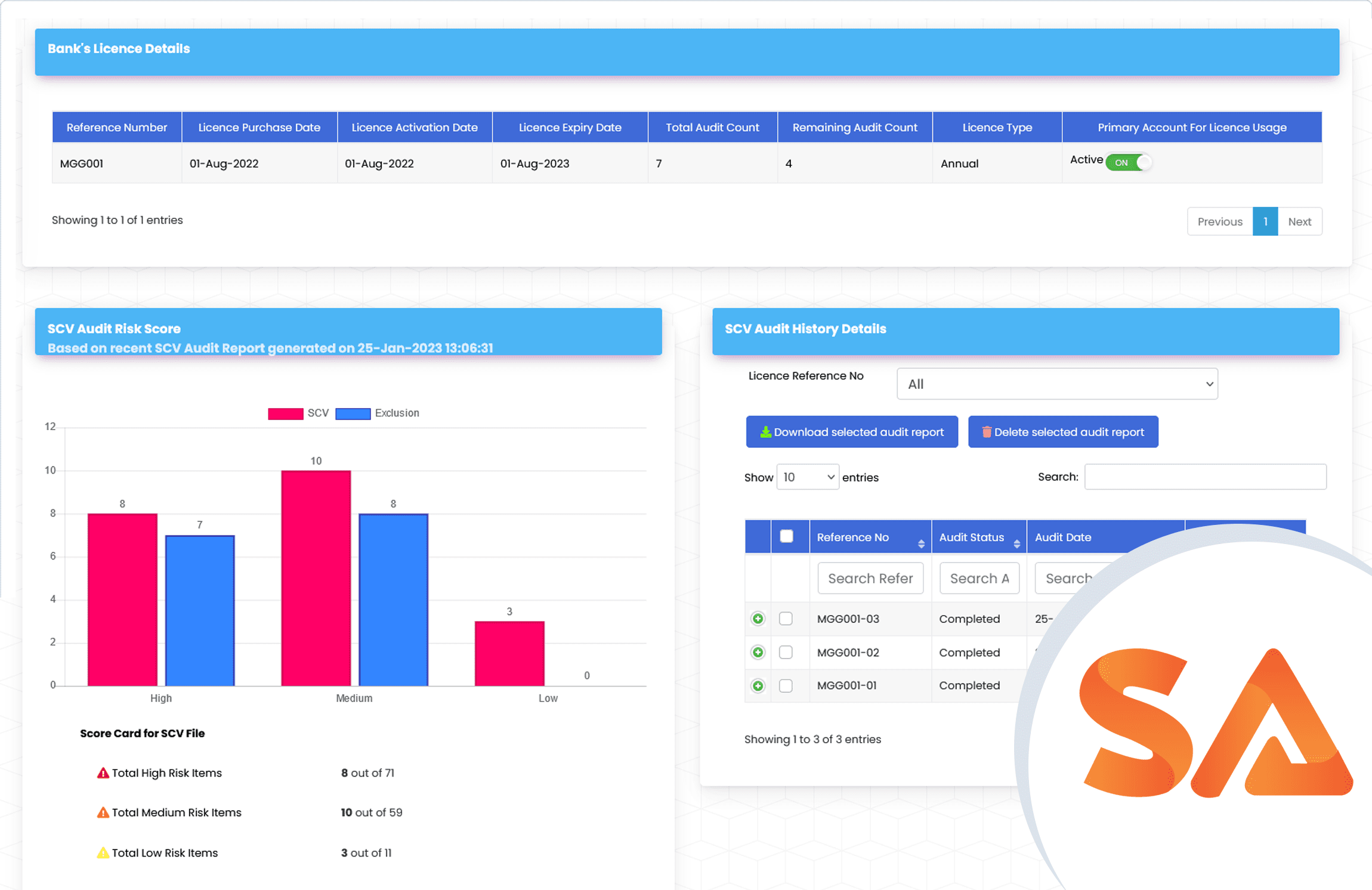

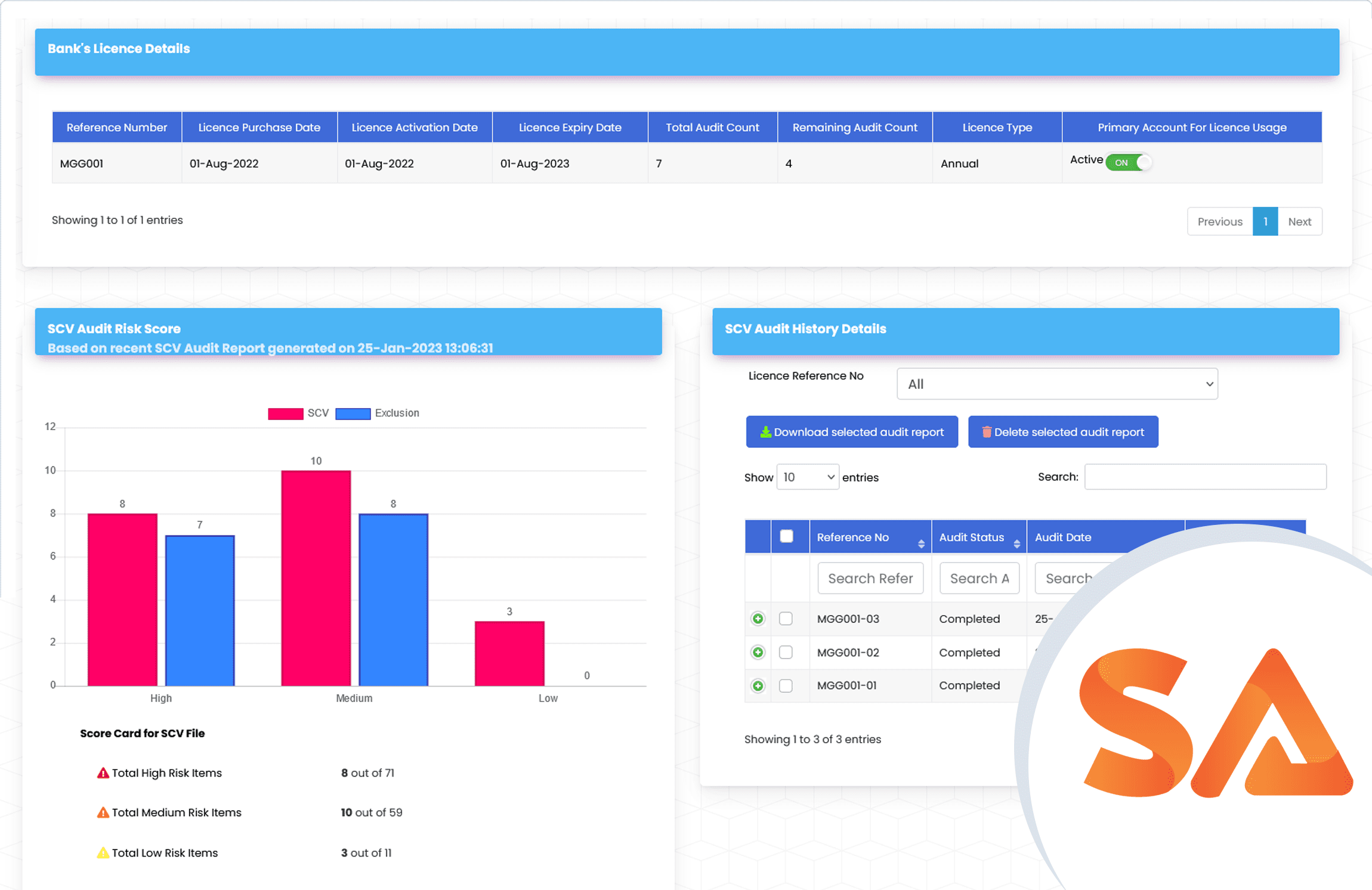

SCV Alliance – FSCS SCV Audit Platform

Validate before you submit. Prove compliance with evidence.

SCV Alliance validates SCV outputs and exclusions against FSCS/PRA expectations with 175+ checks, producing audit-ready reports and evidence.

Best for financial institutions that

- Already generate SCV files but need independent validation against FSCS/PRA expectations

- Need audit-ready evidence for governance, internal assurance, or regulatory scrutiny

- Want structured FSCS SCV reporting on effectiveness, completeness, and exceptions to improve audit readiness

- 175+ validation & risk checks across depositor, account, balance, exclusions, and reporting logic

- Exception reporting + evidence packs to support remediation, governance review, and audit trails

- Effectiveness, completeness & reconciliation insights to strengthen SCV readiness over time

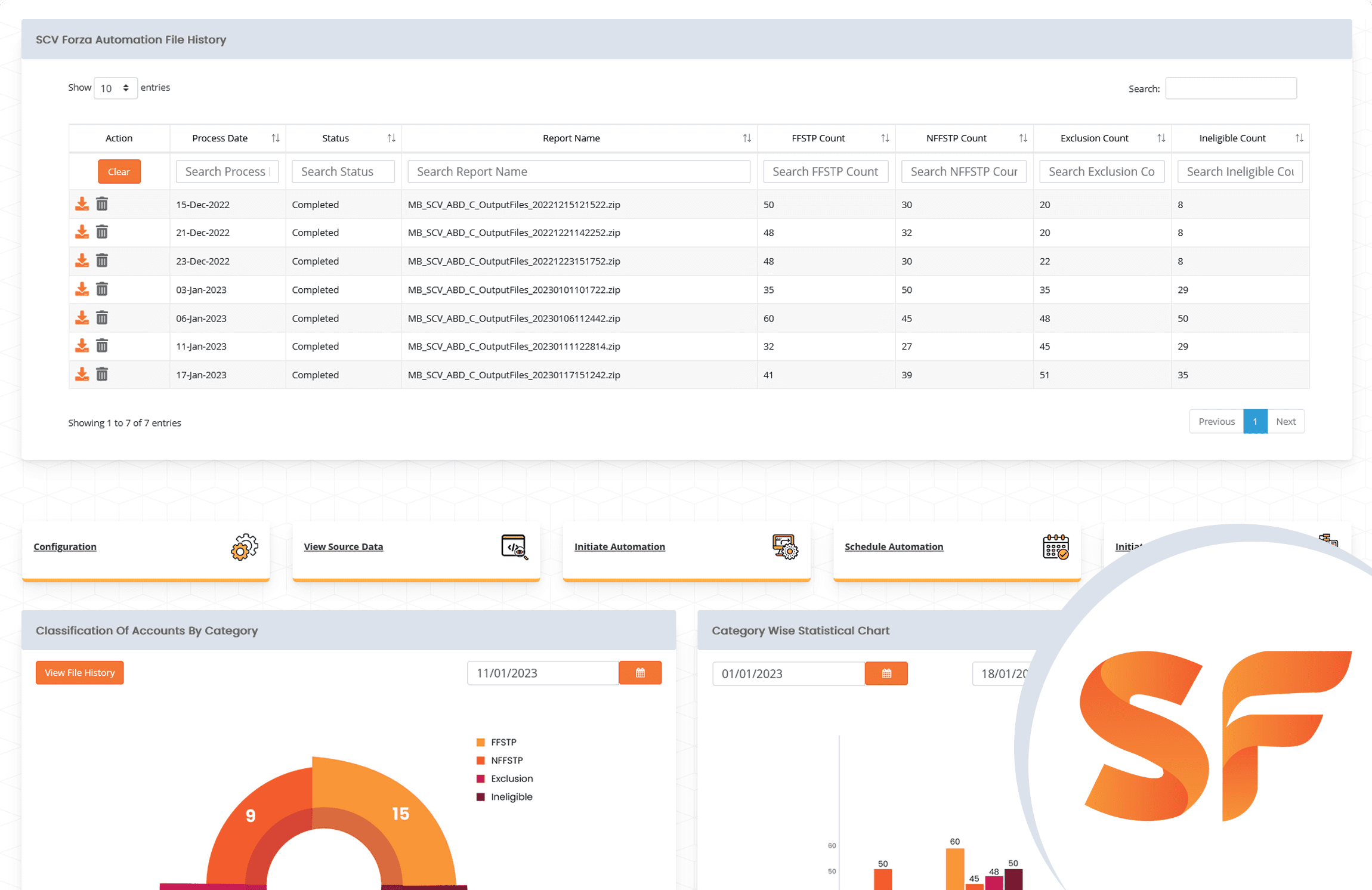

SCV Forza - FSCS SCV Automation Platform

Automate SCV file generation — from source to submission.

SCV Forza automates SCV data preparation, file generation, and reconciliation across your CBS and data repositories — producing accurate, FSCS-compliant SCV outputs with built-in controls, lineage, and evidence packs for every reporting cycle.

Best for financial institutions that:

- Operate across multiple CBS, ledgers, or legacy systems

- Struggle with incomplete, inconsistent, or fragmented depositor/account/balance data

- Need automated reconciliation, rule checks, and submission-ready SCV files every cycle

What you get

- Automated data consolidation, cleansing, and enrichment for depositor, account, and balance datasets

- Built-in reconciliation + FSCS/PRA-aligned validation checks to detect inconsistencies and misclassifications

- Submission-ready SCV outputs with evidence packs, lineage, and traceability to support audit and governance

Platform Capabilities

Stay on Top of FSCS SCV Compliance and Meet Regulatory Deadlines with Confidence

SCV File Generation & Submission Outputs

Generate FSCS-ready SCV output files in the required format – validated, complete, and ready for submission every cycle.

Data Quality Cleansing &

Enrichment

Fix missing, inconsistent, and duplicate depositor data with automated cleansing, standardisation, and enrichment across source systems.

Reconciliations & Rule Checks (FSCS/PRA)

Reconcile balances and apply FSCS/PRA validation rules to resolve misclassifications, inconsistencies, and exceptions early.

Evidence Packs, Lineage &

Traceability

Maintain audit-ready evidence packs with full lineage and traceability from source data through to final SCV outputs.

Effectiveness & Completeness

Reporting

Measure SCV effectiveness and completeness to identify gaps, improve readiness, and support governance decisions.

Exception Reporting & Analytics Dashboards

Track exceptions, anomalies, and unresolved issues with dashboards and actionable reports so teams can remediate faster.

Looking to Achieve "Green Status Adherence" with PRA and Build Customer Trust?

Our All-in-One FSCS SCV Enterprise Solution Suite has you covered!

How SCV Forza works?

FSCS SCV Automation Workflow: From Data Extraction to Compliant SCV File Generation

SCV Forza streamlines SCV data preparation, validation, reconciliation, and FSCS-aligned reporting through a fully automated four-step process.

01

Automated Data Extraction

Securely extracts depositor, account, product, and balance data from CBS, ledger, and legacy systems, capturing all FSCS-required fields.

02

Cleansing, Validation & Enrichment

AI-driven logic identifies and corrects data inaccuracies and duplicates, enriches records with FSCS-required attributes, and applies PRA/FSCS schema validations for complete data readiness.

03

Smart SCV Reconciliation & Exception Resolution

Automatically reconciles depositor-account relationships, balances, thresholds, and eligibility markers while flagging exceptions early for accurate SCV outputs.

04

FSCS-Compliant SCV/Exclusion File Generation

Generates fully compliant SCV and Exclusion files instantly, aligned with PRA/FSCS standards and complete with audit-ready traceability.

Why Choose Our FSCS SCV Enterprise Suite?

A Proven FSCS SCV Reporting Solution Trusted by the UK Regulated FIs for 15+ Years

All-in-One FSCS SCV Enterprise Solution Suite, a data-driven compliance platform for financial institutions to effectuate the regulatory requirements.

Be Ahead of Your Peers

Periodic upgrades to ensure customers stay ahead of compliance in the ever-changing regulatory environment. You can fully rely on quality and integrity.

Fulfilment / Peace of Mind

Gain peace of mind with our FCA-recognised SCV reporting solution, ensuring seamless electronic submissions to RegData with accuracy and security.

Operational Efficiency

Boost efficiency by eliminating manual inefficiencies and accelerating account balance reconciliation between systems.

Reduce Risk

Our advanced matching algorithms, preset business rules, and automated validation minimises compliance risks, ensure accuracy, reducing operational losses and strengthening regulatory control.

Rapid Turnaround

Our FSCS SCV reporting solution for banks and FIs gives users the competence to drill down their data to any level of granularity with the ability to track, monitor, remediate and scale up your data with minimal man-hours.

Strategic Guidance

Expert business consulting to optimise data governance and gain operational best practices in the FSCS reporting landscape.

We Do Not Spare Any Effort in Ensuring Data Security and Compliance

Fully compliant with industry standards, our FSCS SCV Enterprise Solution Suite ensures robust data protection on a secure Azure Cloud with flexible architecture and multi-factor authentication.

Data Security & Encryption

Controls

- Robust 256-bit encryption

- Asymmetric AES with RSA / Diffie–Hellman key exchange

- Secure data capture

- SAS, EIT, EAR encryption standards

- JWS for secure packaging & update management

- GUID implementation for unique, tamper-proof identification

- SOAP API services with secure encoding

- Microsoft Enterprise-grade Security

Application Security & Access Protection

- Complies with ISO & OWASP security standards

- Parameter-level validation to prevent injection attacks

- Behaviour-based security CAPTCHA

- URL copy prevention

- 3D Secure authentication

- Latest MVC framework security standards

- Strong customer authentication

- Session management to prevent hijacking

- IP restrictions for the Admin Portal

Network & Infrastructure

Security

- SAS, EIT, EAR, NLC and multi-layer firewall protection

- Physical and Web Application firewalls

- Malware protection

- Periodic VAPT (Vulnerability Assessment & Penetration Testing)

- Secure authentication and access control

- Resilient hosting environment (implied by enterprise-grade setup)

Governance, Compliance & Data Handling

- Stringent data retention policies

- Compliance with ISO security frameworks

- Compliance with OWASP secure coding practices

- Admin-level access restrictions

- Full auditability via SCV Alliance governance

Still Not Convinced? Hear What Our Clients Say

We have been working with Macro Global for good 7+ years and the team is unique with their approach and hold their patience with limitless iteration to resolve the problem by engaging great attention to detail on root cause analysis. We can rely on them in almost on all critical priorities and their support is second to none. Great bunch of professionals and we look forward working with them for the foreseeable future.

RBL has worked with Macro Global for over three years. We find their service to be first class. The team are exceptionally helpful and professional. In our opinion we couldn’t ask for a better business provider and would recommend Macro Global to all concerned.

Pleased with the timely delivery, excellent service standards, easy accessibility and professional approach of the Macro global team. From our business experience of the past 5 years, we can say it is a reliable, growing outsourcing firm excelling in execution, customer support and delivery commitments, and helping us to meet the regulatory reporting targets.

I feel that the team at Macro Global is amongst one of the best I have ever interacted with in my career. Their expertise in the subject matter, understanding and documentation of processes, detailing of every step of the project and ability to deliver on regulatory reporting (SCV & CRS) and technology platforms (PSD2) amid tight timelines is commendable. This coupled with an visionary leader – Saro, guiding them is a sure-shot recipe for success. I wish them best of luck and am sure they will grow to even greater heights!

Previous

Next

FSCS SCV Reporting FAQs – How Our Solution Supports You

Is All-in-One FSCS SCV Enterprise Solution Suite certified or aligned with FCA/FSCS compliance standards?

Our 10th gen All-in-One FSCS SCV Enterprise Solution Suite is built on FCA-compliant principles and incorporates FSCS’s SCV regulations and PRA’s Green Status Adherence criteria, making it a fully aligned FSCS reporting solution.

How does the platform ensure FSCS “Green Status Adherence” with the PRA?

Through automated validations, data quality checks, exception reporting, and full audit trails, All-in-One FSCS SCV Enterprise Solution Suite empowers institutions to consistently meet the data readiness and accuracy requirements of PRA’s Green Status Adherence.

How frequently are compliance rules and FSCS validations updated?

Our experienced FSCS SCV subject matter experts continuously monitor evolving FSCS regulations, PRA audit expectations, and industry best practices. Our SCV Reporting Software Suite receives regular updates, with quarterly patches and compliance rule enhancements seamlessly integrated into the platform—ensuring your SCV reports remain fully aligned with the latest FSCS standards at all times.

Does the FSCS SCV compliance platform provide insights into data completeness and reconciliation?

Yes, built-in analytics tools provide detailed views on data completeness, exclusions, and reconciliation status to support decision-making and regulatory compliance.

Does the SCV reporting platform suite support electronic report submissions via RegData?

Yes, our All-in-One FSCS SCV Enterprise Reporting Solution Suite supports electronic report submission through RegData, streamlining end-to-end compliance workflows.

Is there downtime during implementation or migration?

Deployment is designed to be non-disruptive, with minimal to zero downtime, leveraging parallel processing and batch scheduling to avoid business interruption.

How is data encrypted during processing and transmission?

Our FSCS SCV reporting platform suite applies end-to-end encryption protocols (AES 256-bit), SSL/TLS for in-transit data, and at-rest encryption to safeguard sensitive customer information.

Where is SCV reporting platform hosted can we choose regional Azure cloud instances?

Our SCV reporitng platform can be hosted on UK Azure Cloud environments in compliance with your data sovereignty and residency policies.

How does the system handle data masking or anonymisation during audits?

Our fscs single customer view reporting platform supports dynamic data masking and pseudonymisation for sensitive data elements during audit processes, ensuring privacy without compromising validation accuracy.

What kind of onboarding support is provided for new customers?

Our FSCS SCV SMEs offer a comprehensive onboarding plan designed to ensure a smooth and efficient implementation. This includes a detailed onboarding questionnaire to configure institution-specific settings (a one-time setup), seamless support for data mapping with Core Banking Systems (CBS) or any other data sources, and end-to-end user training sessions to empower your teams with full platform proficiency from day one.

Do you offer documentation or guided walkthroughs for FSCS SCV report generation?

Absolutely, our FSCS SCV Enterprise reporting Solution Suite is designed with user-friendliness in mind, featuring built-in tooltips and in-product user manuals to guide you every step of the way. In addition, our dedicated knowledge base provides access to comprehensive tutorials, step-by-step guides, expert best practices, and video walkthroughs. And whenever you need extra help, our 24/7 support team is just a call or message away to assist you in real time.

Is consulting available for FSCS audits or regulatory reporting reviews?

Yes, our SME consulting team offers governance and regulatory consulting for FSCS compliance audits, PRA guidelines, and data assurance.

What SLAs do you offer for issue resolution or support?

We offer 24/7 support with customisable SLAs based on client tiers, including guaranteed response times and priority handling for regulatory deadlines.

Are quarterly platform updates included in the license or subscription?

Yes, our SaaS-based SCV reporting platform suite includes quarterly compliance updates and new feature rollouts as part of the annual license or subscription fee—ensuring you stay aligned with the latest FSCS requirements without any hidden costs.

FSCS SCV Reporting Insights, Guides & Case Studies

BUSINESS CASE

BUSINESS CASE