© 2026 Macro Global. All Rights Reserved.

Traverse the article

The international remittance landscape’s challenges are mounting, and compliance in the remittance industry is more demanding than ever. As remittances have grown over the years, the associated risks have also increased significantly. Evolving global regulations around KYC, AML, and sanctions screening require more than manual checks and siloed systems. Delays, errors, and compliance gaps can lead to regulatory penalties and lost customer trust.

NetRemit, with decades of experience in the international remittance industry, delivers a compliance-first solution built for today’s regulatory and operational demands. Fortified with a comprehensive Compliance Management Console, it helps businesses meet complex requirements without compromising speed or user experience.

This blog outlines how NetRemit transforms compliance into a strategic advantage—from onboarding and document validation to real-time transaction monitoring and intelligent risk escalation. This blog will help compliance heads, CROs, CISOs, product leaders, and operations teams to future-proof their remittance infrastructure with smart, scalable compliance.

Overview of NetRemit’s Advanced Compliance Management

At the core of NetRemit is a rule-based compliance engine that operates in real-time and integrates across every phase of the customer and transaction journey.

This intelligent compliance layer enables remittance service providers to:

- Enforce multi-jurisdictional regulatory requirements without custom development.

- Automate sanctions, PEP screening, velocity controls, and KYC verification.

- Adapt to risk profiles dynamically, based on corridor, customer type, or transactional behaviour.

By blending automation, configurability, and audit-readiness, NetRemit empowers service providers to:

- Reduce manual intervention while increasing review accuracy.

- Minimise fraud risk and exposure to penalties.

Deliver faster, frictionless customer experiences, experiences without compromising on governance.

Build a Customised Onboarding Journey with NetRemit

A secure remittance ecosystem begins with strong and regulatory compliant customer onboarding. NetRemit empowers remittance service providers to design flexible, risk-based customer onboarding journey aligned with their regulatory requirements and business policies.

Key configurable steps include:

- Mobile Number & Email Verification: OTP-based mobile validation and email confirmation ensure reliable communication and reduce identity fraud.

- Selfie (Liveness) Verification: Biometric face match enhances identity assurance and prevents spoofing.

- Document Capture and Identity Validation: Upload and verify ID, address proof, or EDD documents via integrated APIs or manual workflows.

- Terms and Conditions Consent: Enforce acceptance of T&Cs, privacy policies, and PEP/sanctions checks before activation.

Flows can be tailored by customer type (retail vs. SME), risk level, or onboarding phase, with relaxed rules in the first week. Every step is audit-logged, ensuring transparency, traceability, and regulatory readiness.

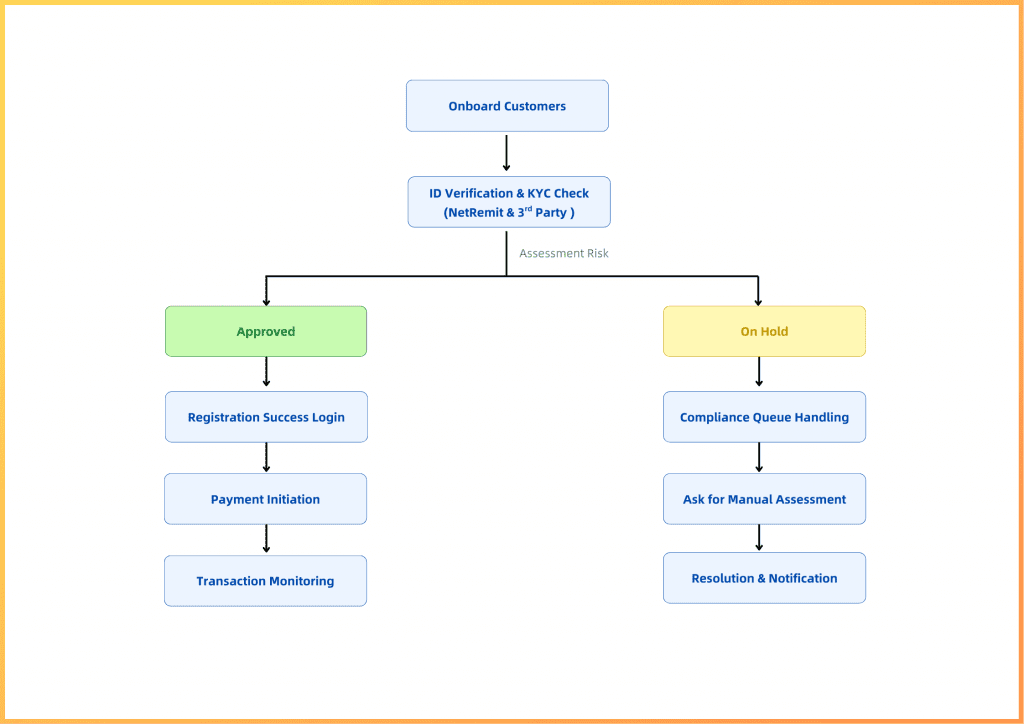

Steps Involved in the Onboarding Journey

Strong compliance begins at the first touchpoint and empowers remittance businesses to craft risk-aware, fully configurable onboarding experiences tailored to both regulations and customer profiles.

NetRemit makes onboarding smarter, safer, and fully adaptable to your business and compliance needs.

Here’s how NetRemit helps you build it:

- Multi-Layered Customer Validation: Configure essential KYC steps like mobile OTP, email verification, and selfie (liveness) checks using facial recognition to validate identity and prevent fraud.

- Document Capture & Identity Verification: Collect and auto-verify ID/address documents via integrated APIs. High-risk profiles are routed for manual review, balancing compliance with a smooth user experience.

- Policy Consent & Risk-Based Escalation: Customise onboarding based on user type, region, or corridor. Apply relaxed rules for new users (e.g., in the first week) and stricter flows for high-risk corridors with auto-escalation triggers.

- Role-Based Configuration and Preferential Journeys: Assign dynamic onboarding paths to different user roles—offering faster journeys for pre-vetted or low-risk customers while upholding regulatory rigor for others.

Managing Transaction Rules and Limits

- Complete Control Over Transaction Flow: NetRemit empowers remittance businesses to control fund movements through rule-based automation—blocking, allowing, or escalating transactions as needed.

- Configurable Rules for Real-World Risks: Set rules based on corridors, customer type, or transaction purpose—aligning compliance with practical risk scenarios.

- Multi-Layered Limit Controls: Apply transaction value caps, frequency limits, and rolling thresholds—ensuring compliance across all user behaviours.

- Corridor-Specific Thresholds: Adjust limits based on geographic risks—tighten controls for high-risk corridors, relax them for low-risk ones.

- Intelligent Queue Management: Flagged transactions are queued for manual review—enabling compliance teams to act quickly and decisively.

- Balanced Compliance and CX: NetRemit helps you stay compliant while maintaining a smooth customer experience by applying smart, non-intrusive checks.

Common vs. Preferential Rules & Corridor-Based Compliance

NetRemit enables layered compliance with two key rule categories:

Common Rules acts as the default compliance framework—defining transaction value limits, velocity thresholds, and behavioural patterns applied across all customers. These rules ensure a consistent baseline of control.

Preferential Rules offer flexibility for specific users—allowing businesses to override default limits for high-value, trusted, or pre-vetted customers. This feature supports loyalty, improves experience, and accelerates transaction flow for low-risk profiles.

In addition, Corridor-Based Rules allow you to set specific thresholds and requirements per remittance corridor. This means tighter rules can be applied to high-risk regions, while smoother journeys are maintained in compliant corridors—ensuring regulatory alignment and operational efficiency across borders.

Compliance Workflow Options: When and How Rules Are Applied

NetRemit delivers a layered compliance framework that balances regulatory rigor with user experience. Businesses can customise enforcement pre- or post-funding based on corridor, customer type, or risk level, ensuring strong compliance without unnecessary friction.

- Pre-Transaction (Pre-Fund) Compliance: All compliance checks, such as KYC validation, sanctions screening, transaction limit verification, and more, are enforced before funds are collected. This model is ideal for high-risk corridors or new customers, eliminating exposure to non-compliant transactions and effectively mitigating chargebacks.

- Post-Fund Collection Compliance: In lower-risk corridors or with existing customers, funds can be collected first. The transaction then passes through the compliance engine. If red flags arise, NetRemit holds the transaction for manual review or auto-refund, with all actions audit-logged.

- Hybrid Compliance Model: Combines the best of both. High-priority rules are applied before fund capture, while deeper compliance steps (e.g., enhanced due diligence or behavioural scoring) occur post-collection. This model is perfect for balancing frictionless CX with regulatory depth.

The Compliance Queue: Real-Time Risk Management

In a high-velocity remittance environment, risk events must be flagged, reviewed, and resolved without interrupting legitimate transaction flows. NetRemit’s Compliance Queue is purpose-built to manage this in real time—ensuring every flagged transaction is handled with precision, transparency, and accountability.

Intelligent Flagging and Queue Assignment

Transactions are automatically flagged and routed into the queue based on configurable compliance rules, including transaction velocity, amount thresholds, expired KYC credentials, or behavioural red flags derived from integrated risk assessment models. These triggers include sanctions hits, watchlist matches, or repeated remittances to high-risk corridors or beneficiary patterns.

Actionable Back-Office Controls

Within the Admin Console, compliance officers gain full control over flagged records via the Customer Maintenance module. Under the Actions menu, teams can launch IDV (Identity Verification) flows, including watchlist screening, biometric checks, and document revalidation for enhanced assurance.

Compliance teams can:

- Update or enrich customer records with refreshed data.

- Initiate real-time IDV to assess compliance against PEP/sanctions databases.

- Block, unblock, or restrict transaction capability based on risk status.

Assign outcomes such as pass, fail, or in review—with each action logged to ensure audit readiness.

Escalation and Audit Trail

For complex or high-risk cases, NetRemit allows seamless escalation to senior compliance teams, embedding multi-level review workflows. Every action, whether manual override, document review, or risk tag, is immutably logged for regulatory audits, internal governance, or future case referencing.

It’s real-time, traceable, and tightly integrated with identity validation. The platform doesn’t just detect anomalies but supports with the tools, data, and transparency needed to maintain both regulatory integrity and customer confidence.

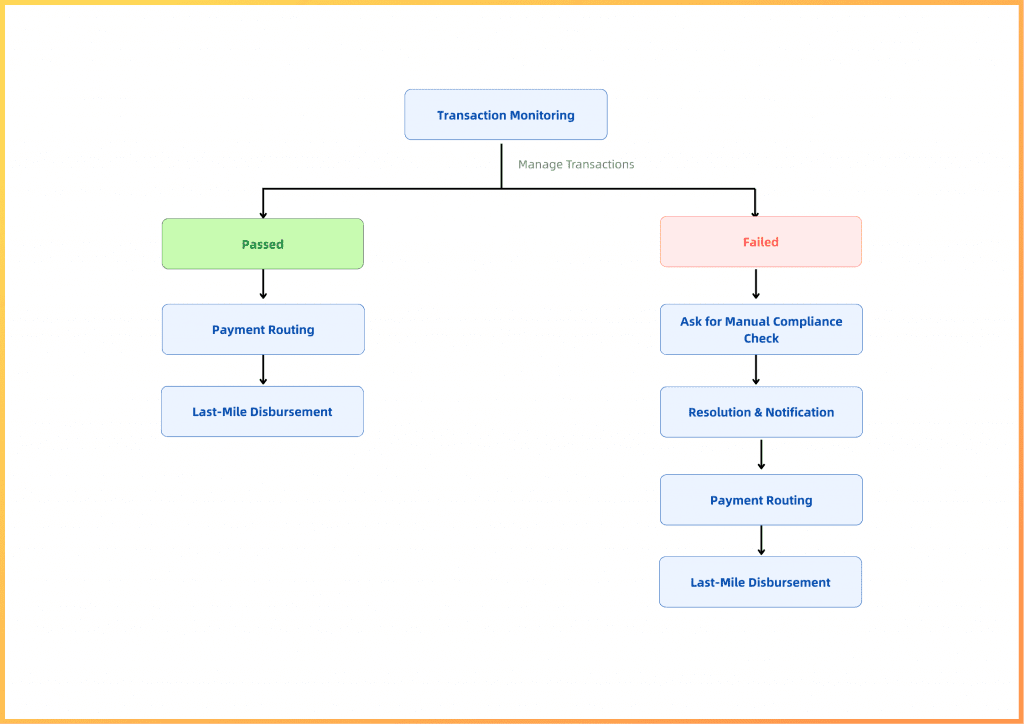

Transaction Monitoring Status and Escalation Paths

NetRemit’s compliance engine ensures that every transaction is evaluated with accuracy, speed, and accountability. By combining intelligent automation with human-in-the-loop review, NetRemit empowers providers to manage transaction risks in real time—while staying fully compliant and audit-ready.

Let us explore in detail:

- Real-Time Compliance Check: Each transaction is screened instantly against NetRemit’s rule engine, including sanction lists, velocity thresholds, corridor-specific mandates, and more.

- Status Assignment: Transactions are categorised into one of three core compliance statuses:

- Pass: All checks are met, and the transaction proceeds seamlessly to payout.

- Fail: One or more compliance violations are detected (e.g., flagged entity, rule breach). The transaction is automatically blocked.

- In Review: If a transaction falls into a grey area, it is routed to the compliance queue for further manual analysis.

- Manual Investigation: For transactions “In Review,” compliance analysts can seamlessly examine transaction metadata, review sender/beneficiary history, and validate attached documents or patterns as part of the manual investigation process.

- Suspicious Activity (SA) Tagging: Flagged transactions can be tagged as Suspicious Activity (SA) based on findings:

- Internal SA for internal monitoring, triggering heightened scrutiny or audit actions, and

- External SA for regulatory reporting as per AML protocols, which automatically freezes further transaction activity.

- Escalation to Regulators: If a transaction is tagged as External SA, NetRemit facilitates structured reporting to regulatory bodies like the FCA, ensuring full compliance with local AML/CFT obligations.

- Refund Management: If a transaction fails or is declined during review, the system initiates a compliant refund protocol, ensuring that funds are returned with traceability and integrity. Audit logs are maintained to support both internal reviews and external audits.

- Audit Trail and Reporting: All decisions, actions, and escalations are captured in an immutable compliance log—ready for regulator access, audit preparation, and internal oversight.

Benefits of Using NetRemit

NetRemit is a one-stop platform, that provides intelligent, strategic layers that empower remittance providers to manage risk, meet regulations, and scale with confidence.

Here’s why service providers around the world trust it:

- Rule-Based Control Engine: Rules can be customised based on corridor, user behaviour, or purpose. Business teams maintain full agility in responding to compliance updates and regional variations.

- Dynamic Risk Segmentation: Customers are automatically flagged and categorised into risk tiers into High, Moderate, or Low, based on real-time activity, behavioural signals, and historical trends. This enables differentiated onboarding, monitoring, and escalation paths per risk class.

- Batch Processing for Compliance Operations: Compliance teams can execute batch-level actions, reviewing, updating, and processing multiple flagged customers or transactions in bulk. This enhances operational efficiency, especially during large data audits or surge activity.

- Tailored Customer Journeys: Onboarding flows adapt dynamically to customer type, region, and risk score. Modular steps like OTP, document upload, and liveness checks can be rearranged or bypassed based on pre-set logic.

- Corridor-Specific Compliance: Logic Apply jurisdiction-specific controls to enforce compliance mandates, locally while maintaining global operational standards—tight where needed, seamless where allowed.

- Zero Chargeback Framework: By enforcing pre-funding compliance checks, NetRemit ensures only validated transactions move forward—eliminating chargebacks and reducing financial exposure.

- Hybrid Enforcement Models: Combine pre- and post-funding rule application depending on transaction type or corridor sensitivity. This hybrid model ensures customer convenience without compromising control.

- Smart Risk Queue and Alerts: Flagged cases are routed to designated compliance teams with priority, context, and actions pre-logged. Alerts are triggered for suspicious velocity, structuring, and destination patterns.

- Comprehensive Audit Trail: Every decision, manual or automated is logged immutably. From IDV updates to risk escalations, all activity is traceable for internal audits and regulatory review.

- Scalable and Future-Ready: Built to grow across markets, NetRemit now integrates with AML partners, risk analytics engines, and custom scoring systems—ensuring it adapts as compliance expectations evolve.

Wrapping Up

In today’s fast-evolving remittance landscape, compliance is no longer just a regulatory checkbox! It is a critical differentiator. Managing transaction limits, customer onboarding, real-time risk monitoring, and audit-ready workflows can be incredibly complex without the right infrastructure.

NetRemit simplifies compliance through its advanced framework, offering tools like customer journey builders, dynamic transaction rule-setting, and automated escalations. With a rules-driven engine, it allows businesses to tailor compliance flows to match their operational needs and risk levels, ensuring smooth operations with minimal friction.

Looking to scale your remittance operations while staying compliant and competitive? NetRemit by Macro Global is designed to help you build trust, reduce risks, and improve customer experience! An all-in-one integrated suite, NetRemit is not your traditional compliance add-on — it’s your built-in, business-ready compliance advantage.

Future-Proof Your Remittance Compliance with NetRemit

Transform compliance from a regulatory burden into a strategic edge.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Related Posts

4 February 2026 NetRemitNextGen Banking

White Label International Money Transfer Software: A Buyer’s Guide for Banks, MSBs & Fintechs

How banks, MSBs, and fintechs use white-label international money transfer SaaS software to launch fast, stay compliant, & scale remittance business profitably.

10 November 2025 NetRemitNextGen Banking

In Sync with the Industry’s Direction: Macro Global’s Perspective on Money20/20 USA 2025

Know how Macro Global reflects the spirit of Money20/20 USA 2025 by embracing intelligent fintech, agile infrastructure, and cross-border remittance innovation.

29 October 2025 NetRemitNextGen Banking

Money Transmitter Licensing Across the U.S.: A State-by-State Overview

Explore how each U.S. state money transmitter license works as we decode everything from rules, processes to compliance essentials for remittance businesses.