© 2026 Macro Global. All Rights Reserved.

Amidst the challenges vested upon managing diverse regulatory landscapes, fragmented corridor infrastructures, and evolving user expectations, challenges that even the most advanced financial institutions face. Legacy systems, with their operational limitations, are no longer relevant in today’s fast-paced, real-time economy.

Institutions that fail to scale are facing severe backlash, unable to thrive in the fast-paced, competitive landscape. They are also forced to recalibrate business agility with control, responding to regulatory shifts while delivering seamless, scalable payment experiences.

While they look to scale their institution’s performance, it is essential to look for the right partners, appropriate solutions, and mainly compatible with the operations of the parent firm and comply with international regulatory bodies. It is not just a strategic move, but a futuristic shift towards development.

Challenges in International Remittance

Despite the burgeoning growth, international money transfer still suffer from complex domains in financial services, where every corridor introduces a new layer of regulatory, operational, and technological nuance. Despite the proliferation of digital rails and fintech innovation, institutions continue to face fundamental limitations that prevent scale, compliance agility, and real-time delivery.

Let us analyse the challenges in detail:

- Systemic Rigidity of Legacy Infrastructure: Most remittance operations are still anchored in core banking systems designed for batch processing, not real-time settlement. These systems are typically inflexible, making it difficult to adapt to fast-evolving partner APIs, FX logic, or settlement schemas. As corridors diversify and digital wallets rise, legacy infrastructure becomes a bottleneck.

- Fragmented Regulatory Landscapes: Each jurisdiction imposes its compliance stack, ranging from FATF-aligned AML rules to region-specific data localisation mandates. Managing these in-house often leads to brittle, hardcoded rules across disparate systems. Without embedded compliance orchestration, institutions struggle to maintain audit readiness across corridors.

- Latency in Corridor Activation: Expanding into new geographies requires corridor-specific integrations, testing routines, and settlement configurations. The absence of pre-integrated corridor logic forces institutions to engage in multi-month buildouts, delaying speed-to-market and draining internal bandwidth.

- Operational Drag from Manual Interventions: Many institutions rely on semi-automated workflows for onboarding, screening, reconciliation, and exception handling. These manual dependencies increase reconciliation lag, reduce transaction throughput, and introduce regulatory risk, especially in high-volume corridors.

- High Total Cost of Ownership: Owning and maintaining a proprietary remittance stack entails significant upfront capex, compliance engines, corridor integrations, UI/UX layers, and FX infrastructure, all of which require ongoing updates. Moreover, every market expansion reintroduces the same cycle of costs, testing, and resourcing.

- Limited Real-Time Visibility and Control: Legacy systems rarely provide unified, real-time dashboards across corridors, partners, and compliance checkpoints. This lack of observability impairs SLA enforcement, FX tracking, and fraud response, while making it difficult for operations and risk teams to intervene proactively.

How NetRemit RTaaS Addresses the Structural Challenges of Remittance

NetRemit’s approach of Remittance Technology as a Service (RTaaS) is a modular, compliance-embedded, and corridor-ready framework designed to meet the demands of a dynamic CBP environment. With an edge in the industry, it goes beyond streamlined operations.

Here’s how it systematically addresses the structural challenges faced by CBP institutions:

- Modular, API-Driven Architecture Replaces Rigid Legacy Systems: Built on a cloud-native, microservices architecture that decouples remittance functions from core banking systems. Each module can be deployed, scaled, or replaced independently through secure APIs. This enables institutions to respond to corridor-specific demands or partner integrations without rewriting core logic.

- Embedded Compliance by Design: It incorporates jurisdiction-specific compliance protocols directly into the transaction flow. It also has real-time KYC/AML screening, sanction checks, and transaction monitoring built into the orchestration layer. The platform adheres to FATF, GDPR, PSD2, PRA, and other regulatory standards from day one, enabling audit-readiness across geographies.

- Pre-Integrated Global Corridors with Smart Routing: This platform is fortified with out-of-the-box connectivity to a wide network of corridors, payout partners, and wallet systems. Its Universal Transaction Switch intelligently routes transactions based on SLA targets, FX rates, and partner availability, ensuring speed, redundancy, and cost-efficiency.

- Intelligent Automation Reduces Operational Drag: Manual interventions are minimised through rule-based automation and workflow engines. From onboarding to reconciliation, the platform uses efficient configuration and intelligent exception handling to eliminate delays and improve throughput. This automation frees up compliance and operations teams to focus on exceptions and strategic tasks rather than routine interventions.

- Elastic Scalability with Low TCO: The platform follows a subscription-based, pay-as-you-scale model, removing the need for upfront infrastructure investment. Its elastic compute model ensures performance regardless of volume spikes, while reducing the operational overhead and maintenance burdens common with in-house systems.

- Real-Time Visibility and Control Across the Stack: Equipped with live dashboards for corridor performance, FX exposure, SLA tracking, and compliance flags. Role-based access control, maker-checker flows, and automated alerts give institutions the observability and control required for proactive governance and operational integrity.

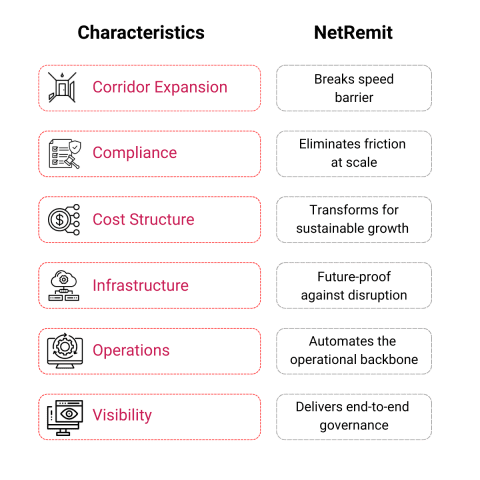

Why NetRemit’s Remittance Technology as a Service is a Game-Changer for Remittance Institutions

NetRemit, driven by forward-looking design, transforms international money remittance from a legacy constraint into a competitive advantage. By addressing deep-rooted operational and compliance challenges, it empowers institutions to scale faster, adapt smarter, and lead confidently in a real-time economy.

Here are the advantages:

- Breaks the Speed Barrier in Corridor Expansion: Traditional corridor onboarding is slow, manual, and resource intensive. NetRemit removes these barriers with multi-corridor interfaces, pre-integrated payout rails and modular APIs, allowing institutions to enter new markets in days, not quarters.

- Eliminates Compliance Friction at Scale: Fragmented compliance stacks are a major source of delay and risk. NetRemit embeds real-time KYC/AML, sanction screening, and data-localisation checks through third-party partners directly into transaction workflows, removing the burden of constant updates and audits.

- Transforms Cost Structure for Sustainable Growth: Moving from capex-heavy infrastructure to a scalable, pay-as-you-grow model dramatically reduces the total cost of ownership. With NetRemit, institutions no longer have to choose between cost control and innovation. Operational efficiency and growth can now go hand in hand.

- Future-Proof Infrastructure Against Industry Disruption: As payment systems evolve real-time rails, CBDCs, AI-driven compliance—NetRemit’s composable, cloud-native architecture ensures institutions can integrate and adapt without reengineering their core. It’s not just about keeping up with change—it’s about being ready to lead it.

- Automates the Operational Backbone: Manual processes in reconciliation, validation, and partner routing create bottlenecks and risk. NetRemit replaces these with intelligent, rule-based automation that improves speed, accuracy, and scale. This shift frees up talent to focus on higher-value initiatives.

- Delivers End-to-End Visibility and Governance: Fragmented views and data silos are no longer acceptable. NetRemit’s live dashboards and audit-ready reporting provide a unified view across transactions, partners, and corridors—empowering compliance, operations, and strategy teams to act on real-time intelligence.

NetRemit RTaaS is not just a solution to current pain points! It’s an enabler of what’s next. It equips CBP institutions to operate with agility, scale with confidence, and innovate without compromise. In a market where speed, compliance, and experience define success, NetRemit turns cross-border payments from a legacy liability into a future-proof asset.

Tailored RTaaS Use Cases for Banks, MTOs, and FX Providers

As the remittance landscape rapidly evolves, financial institutions of all sizes and specialties, whether traditional banks, emerging MTOs, or FX providers require tailored solutions to remain agile, compliant, and competitive. NetRemit’s RTaaS model extends beyond technology, offering an ecosystem of strategic services that align with real-world business goals across varied segments.

Here’s how NetRemit’s Remittance Technology as a Service delivers targeted value across key institution types:

Retail and Challenger Banks: Digitising and Scaling Remittance Services

Challenge: Legacy systems and fragmented corridor partnerships prevent banks from launching modern, scalable remittance services.

Remittance Technology as a Service (RTaaS) in Action:

- Go-to-Market Consulting simplifies the complexities of MSB licensing, partnership acquisition, and corridor prioritisation—helping banks launch compliant services faster.

- Cloud Managed Services provide banks with a resilient infrastructure backbone, supporting real-time settlement and 24×7 availability without internal IT overhead.

- Legacy Migration Support enables seamless transformation from batch-based systems to API-ready, real-time rails without disrupting core banking platforms.

Outcome: Banks launch compliant, digital-first remittance services in weeks—not quarters—while reducing operational drag and compliance risk.

Money Transfer Operators (MTOs): Expanding Reach and Optimising Cost-to-Serve

Challenge: MTOs aiming to scale across new geographies often encounter corridor activation delays, regulatory fragmentation, and operational overheads.

Remittance Technology as a Service (RTaaS) in Action:

- Growth Consulting provides access to 140+ pre-integrated payout corridors supporting instant, same-day, or T+1 settlement with intelligent payment routing logic.

- BPO & Corporate Services offer operational muscle—handling onboarding, reconciliation, exception management, and customer support at scale.

- Compliance Management embeds real-time AML/KYC/sanctions workflows that auto-align with regional standards (e.g., FCA, MAS, FINTRAC), ensuring audit readiness.

Outcome: MTOs scale corridor coverage rapidly while maintaining lean teams, reducing compliance complexity, and optimising cost-to-serve.

FX Providers: Transforming into Cross-Border Remittance Enablers

Challenge: Traditional FX businesses seek to diversify revenue by offering international payouts and wallet-based remittance services—but lack the infrastructure and compliance stack to scale securely.

Remittance Technology as a Service (RTaaS) in Action:

- Go-to-Market Consulting guides FX firms through MSB expansion and partner acquisition to unlock new corridors and use cases.

- Legacy Migration Support transitions proprietary FX systems into modular, real-time remittance-ready platforms powered by NetRemit.

- Cloud Managed Services ensure always-on, secure transaction processing with resilient BCP zones, ideal for volatile corridors and high-volume B2B disbursements.

Outcome: FX providers move beyond currency exchange to deliver scalable, compliant, and differentiated international money transfer solutions.

With NetRemit Remittance Technology as a Service (RTaaS), institutions don’t just gain a plug-and-play platform, they unlock a strategic partner equipped to guide growth, mitigate risk, and accelerate time-to-market. Whether you’re a bank modernising customer remittance journeys, an MTO scaling into new markets, or an FX firm evolving into a international money transfer powerhouse, RTaaS delivers the right combination of infrastructure, intelligence, and institutional support.

FAQs

How is NetRemit different from traditional in-house systems?

Unlike legacy systems that demand long development cycles, high capital investment, and constant compliance maintenance, NetRemit offers a modular, cloud-native Remittance Technology as a Service platform. It comes pre-integrated with corridors, real-time dashboards, and built-in regulatory orchestration—accelerating go-live timelines from months to weeks.

Can NetRemit support my specific payout corridors?

Yes. NetRemit, money remittance software offers access to a broad network of pre-integrated global payout corridors across 140+ countries, supporting B2C, B2B, and wallet-based transfers. New corridors can be added seamlessly via configuration—no coding or custom development needed.

What kind of compliance features are included?

NetRemit embeds compliance directly into the transaction flow with real-time KYC/AML, automated sanction screening, transaction monitoring, and jurisdiction-specific rules aligned with FATF, PSD2, GDPR, PRA, and other global standards—ensuring you’re always audit-ready.

Is NetRemit suitable for both banks and fintechs?

Absolutely. Whether you’re a traditional bank modernising remittance services or a fintech scaling global payouts, our remittance software offers the agility, security, and scalability required—without the overhead of managing infrastructure or compliance in-house.

How quickly can we go live with NetRemit?

Most clients can go live within 4–6 weeks, depending on integration requirements and corridor selection, far faster than the typical 12–18 months required for in-house builds.

Can we white label the remittance platform?

Yes. NetRemit offers fully brandable UI modules that provide a seamless customer experience across web and mobile, enabling you to maintain brand consistency while leveraging our backend infrastructure.

Future-Ready Remittance Technology as a Service

With NetRemit innovate faster, scale smarter, and stay compliant.

Ready to get started?

We can’t wait to show you what’s possible with NetRemit.

Related Posts

4 February 2026 NetRemitNextGen Banking

White Label International Money Transfer Software: A Buyer’s Guide for Banks, MSBs & Fintechs

How banks, MSBs, and fintechs use white-label international money transfer SaaS software to launch fast, stay compliant, & scale remittance business profitably.

10 November 2025 NetRemitNextGen Banking

In Sync with the Industry’s Direction: Macro Global’s Perspective on Money20/20 USA 2025

Know how Macro Global reflects the spirit of Money20/20 USA 2025 by embracing intelligent fintech, agile infrastructure, and cross-border remittance innovation.

29 October 2025 NetRemitNextGen Banking

Money Transmitter Licensing Across the U.S.: A State-by-State Overview

Explore how each U.S. state money transmitter license works as we decode everything from rules, processes to compliance essentials for remittance businesses.